Find out more about the reporting requirements for firms authorised to carry out regulated consumer credit activities.

Regulatory reporting for consumer credit activities is changing. Most of the existing data items will be phased out and replaced.

The information below sets out both the existing reporting requirements as well as information on the ongoing changes.

Overview

Once authorised with permission for credit-related regulated activities, we will require you to report information to us via our online data collection platform RegData. This will be either quarterly, 6-monthly or annually depending on the nature and size of your business.

We will use the information you provide to:

- support our supervisory work

- calculate the consumer credit-related portion of your annual fees (based on your consumer credit income)

The data you provide must not give a misleading impression of the firm. This means a firm must not:

- omit a material item

- include an immaterial item

- present items in a misleading way

All regulatory reporting requirements can be found in the Handbook. Additional information specifically on reporting in relation to consumer credit related activity is provided below.

In particular consumer credit firms should refer to the templates for data items relating to consumer credit activities and the related guidance notes.

Existing consumer credit reporting requirements

There are currently 6 active data items scheduled in relation to credit-related regulated activity.

| Data item | Name |

|---|---|

| CCR001 | Financial Data |

| CCR002 | Volumes |

| CCR003 | Lenders |

| CCR004* | Debt Management Firms |

| CCR005* | Client Money & Assets |

| CCR006 | Debt Collection |

| CCR007 | Key Data for Credit Firms with Limited Permissions |

| CCR009* | Relevant Ancillary Credit Firm |

*CCR009 came into effect on 7 May 2025. It replaces CCR004 and CCR005.

Firms with a reporting period end date after 6 May 2025 do not need to complete CCR004 and CCR005.

Further data items may also be required in relation to other permissions held by a firm.

Product sales data

Product sales data (PSD) collections provide detailed information on individual credit agreements. This includes:

- Sales PSD: characteristics of the agreement and borrower at the start of the agreement (sales PSD).

- Performance PSD: in some cases, the ongoing activity in relation to these agreements.

Visit our page on PSD credit agreements to find out:

- Who needs to provide PSD returns.

- Details of the technical requirements.

Find out more about PSD credit agreements

CCR009 – Relevant Ancillary Credit Firm

CCR009 collects data from all consumer credit firms with permission to carry out the following regulated activities:

- credit broking

- debt adjusting

- debt counselling

- providing credit information services

Upcoming changes

The existing consumer credit regulatory returns were introduced in 2014. Firms, markets and the way we regulate have all changed significantly since then. We are in the process of replacing most of the existing data items with a new set that will:

- provide a baseline for us to monitor and assess firms’ ability to meet our threshold conditions on an ongoing basis

- identify firms who exhibit high risk characteristics

- prioritise our resources

- take quicker action against firms presenting the highest risk of harm to consumers and the market

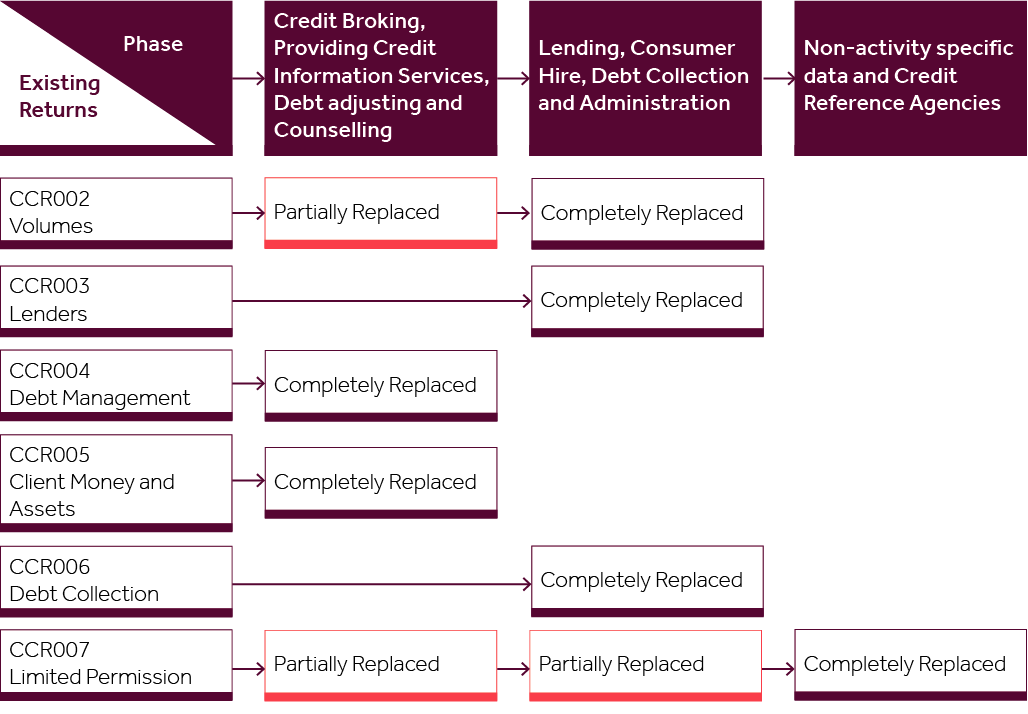

Alongside the new PSD reporting for regulated credit agreements, we are also replacing the data items CCR002 to CCR007.

The new data items will include questions about how a firm uses their permissions for credit-related regulated activity, and how this contributes to their overall business model.

The design and introduction of these new returns is broken down into phases, considering the different credit-related regulated activities.

We recognise new data requests can be a burden for firms.

After introducing the new CCR009 return, and as part of our work to support growth, we have decided to slow down the pace of change.

We’ve paused work to replace all the remaining consumer credit returns, to allow:

- Firms more time to implement existing changes.

- Us to assess the impact and value of the new returns before we decide our future data needs.

Firms will report CCR009, and future returns for the remaining regulated consumer credit activities, on a calendar year basis, moving away from schedules based on a firm’s accounting reference date.