CP17/41: Individual accountability (PDF)

The Senior Managers and Certification Regime aims to make individuals more accountable for their conduct and competence. Earlier this year, we consulted on our proposed approach to extending the regime to insurers and individuals.

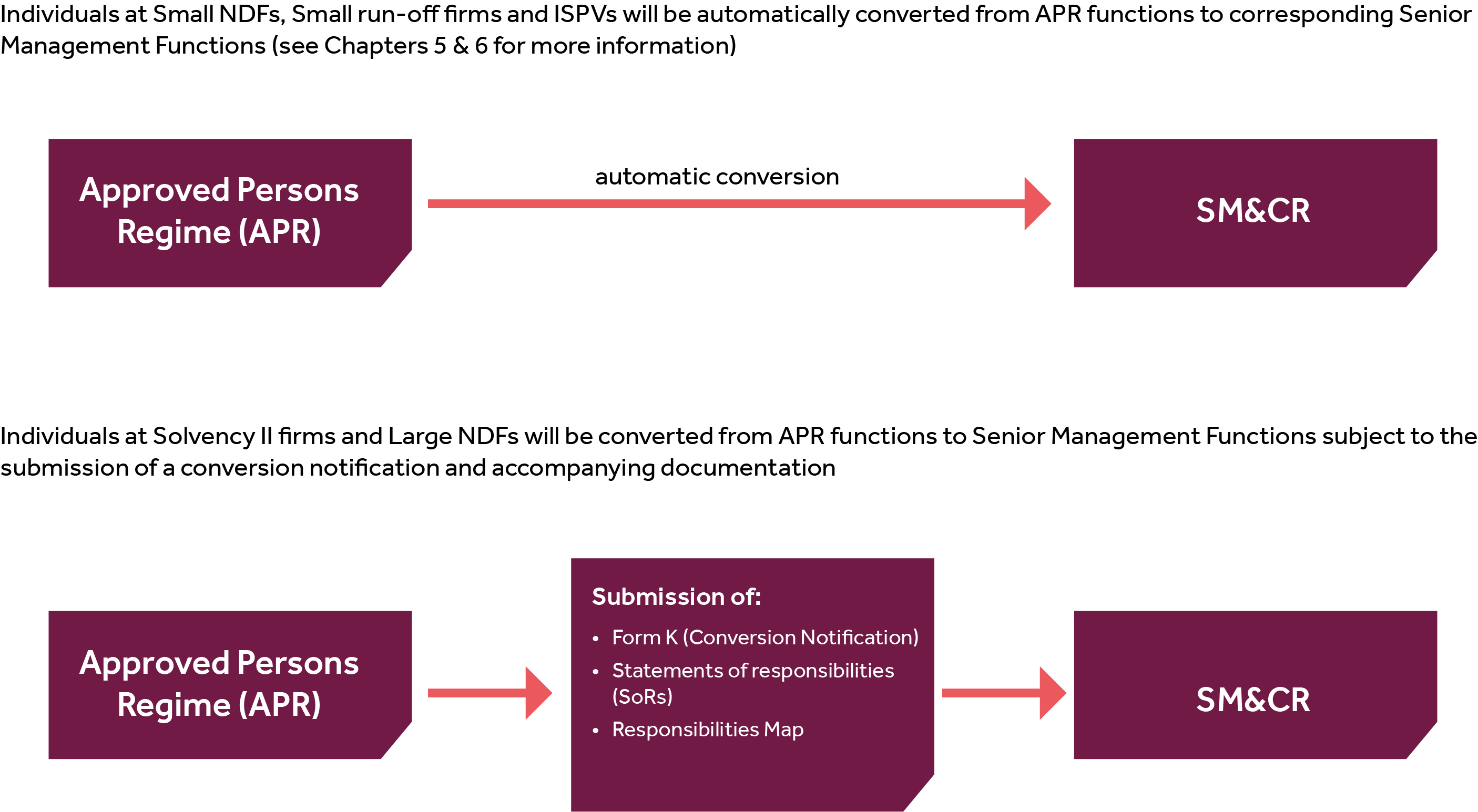

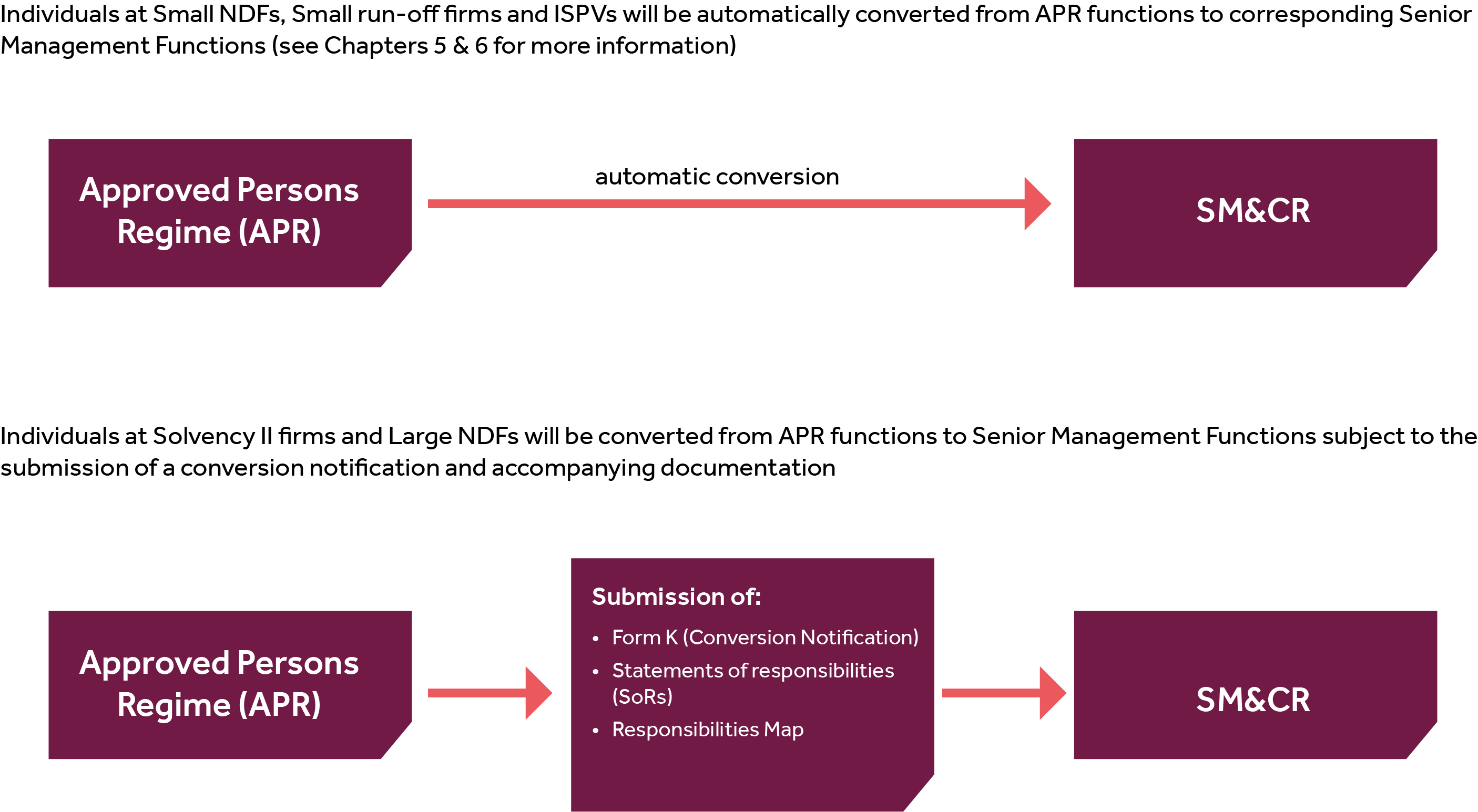

This consultation paper sets out how we propose to move firms and their senior staff over to the new regime. We're calling this process 'conversion', and our aim is to make conversion simple, clear and proportionate. To do this, we’ve proposed different approaches depending on whether the insurer is:

- a firm subject to Solvency II or a large Non-Directive Firm

- a small Non-Directive Firm or a small run-off firm

- an Insurance Special Purpose Vehicle

The consultation sets out the detailed proposals for all types of insurers. This includes transitional provisions to give firms time to adapt to the new regime and associated changes to our handbook.

Who this applies to

The proposals in this consultation apply to all dual-regulated insurance firms. As well as the firms themselves, the proposals will affect everyone performing financial services roles at those institutions.

The proposals in this consultation do not extend to approved persons and individuals at Appointed Representatives of insurers.

Consumers may be interested how individual accountability is being enhanced within financial services.

Next steps

This consultation has now closed. We will consider your feedback and aim to publish a summary of responses and a policy statement in 2018.