FCA economist Peter O’Neill and Academic Shihao Yu at Columbia University, examine the role of new High-Frequency Trading (HFT) entrants to the once bank dealer dominated Foreign Exchange market.

This article summarises work described in detail in Occasional Paper 63.

Financial markets have undergone significant structural changes in the last two decades. Most transactions used to take place between dealer banks and were executed by telephone. Today these trades are predominantly electronic, automated and fast-paced, and new market participants, called ‘high-frequency traders’ (HFTs), have made substantial inroads.

This new automated market-structure has brought benefits in equities markets in the form of narrower bid-ask spreads (which reduce transaction costs for small retail trades) and greater price efficiency (so that security prices better track their fundamental values).

The impact of automation in foreign exchange (FX) markets is much less certain, receiving limited attention from researchers in comparison to equities markets. This is despite FX being the largest market in the world (trading over $ 5 trillion a day).

In this paper we examine the impact of HFTs on FX markets, and contrast and compare their roles as liquidity providers with more established dealer banks.

Liquidity provision in normal periods

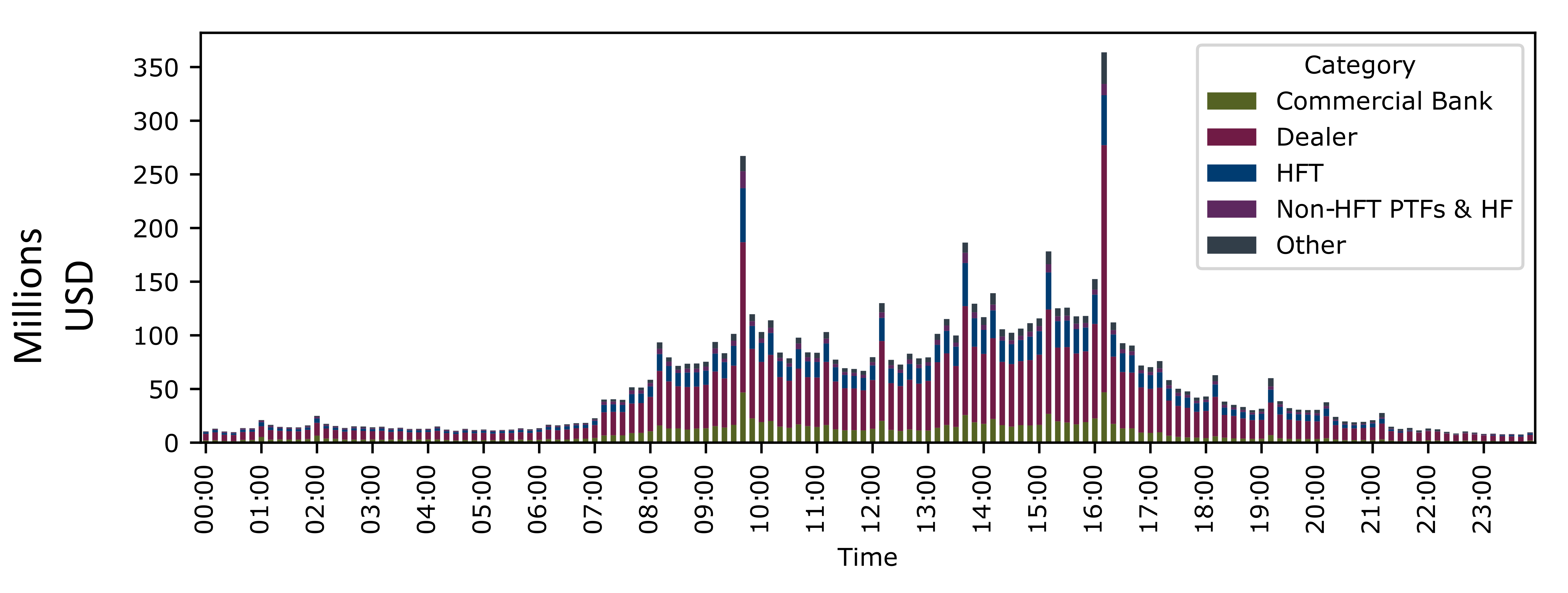

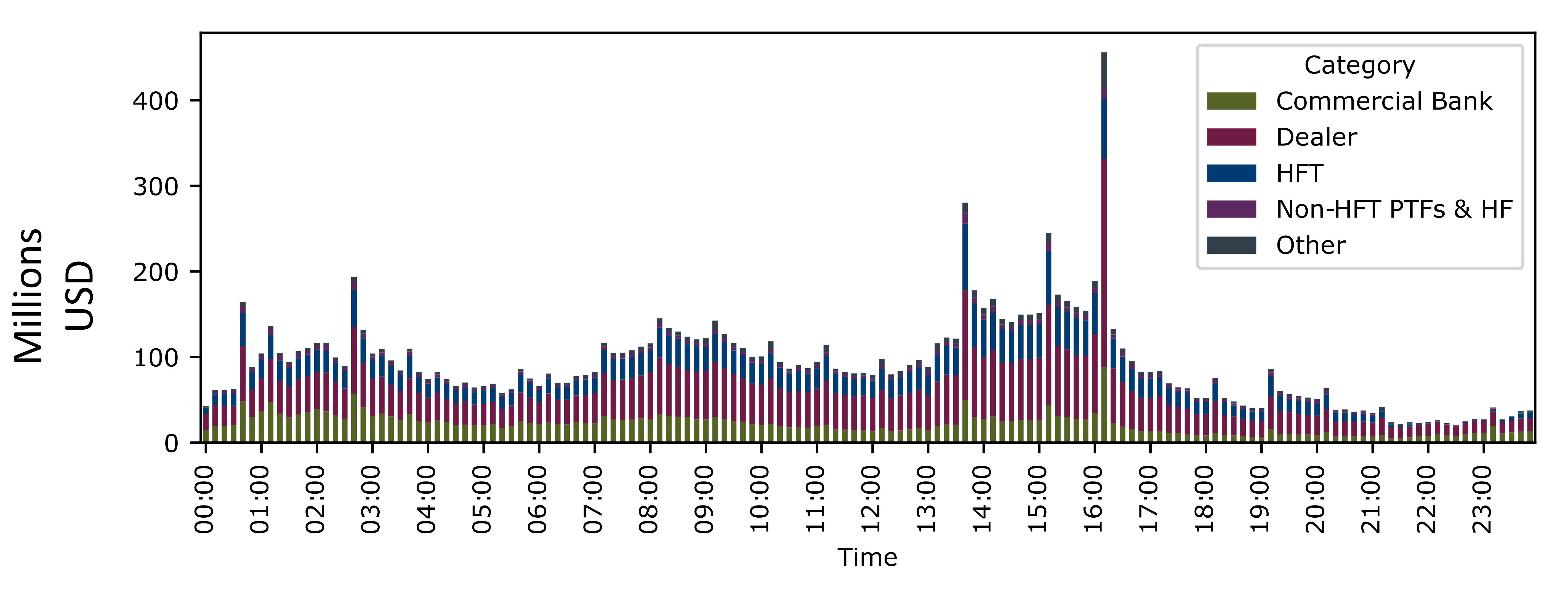

We begin by examining simple measures of liquidity provision by HFTs and dealer banks. Figure 1 presents the average intraday passive volume over the sample period in each 10-minute interval. Passive volume is measured as trading volume in which a participant does not initiate the trade, i.e. they leave an order to rest on the orderbook that executes at a price that another participant agrees to execute at.

Figure 1 shows that dealers (still) provide the majority of orderbook liquidity. They account for a larger share of total trading volume: 45.3% and 41.4% in GBPUSD and AUDUSD versus 33.5% and 33.1% for HFTs respectively. They also account for a larger proportion of passive trades: 62.2% and 54.3% vs. 25.2% and 35.6% for HFTs.

Figure 1. Intraday passive volume

This figure plots the intraday passive volume decomposed to different trader categories at 10-minute intervals.

However, we find that HFTs provide more ‘resting liquidity’ in the form of a larger share of the first level (at which the best price is available) of the orderbook and tighter bid-ask spreads on average, as shown in Table 1 below.

Table 1. Overview order-book liquidity provision by trader category

This table presents several stylised facts of the liquidity provision of different trader categories. RQS is the (half) relative bid-ask spread. DepthTop is the top-of-book depth. DepthTopShr is a trader category's top-of-book depth as a fraction of the total top-of-book depth. Means and standard deviations are computed across daily averages.

| Measure | RQS (bp) | DepthTop(mil) | DepthTopShr | ||||

|---|---|---|---|---|---|---|---|

| Mean | SD | Mean | SD | Mean | SD | ||

| GDP/USD | Dealer HFT | 1.34 0.88 | 0.29 0.15 | 2.30 3.54 | 0.56 0.84 | 0.33 0.50 | 0.06 0.07 |

| AUD/USD | Dealer HFT | 1.97 1.18 | 0.51 0.23 | 2.71 6.25 | 0.62 1.67 | 0.25 0.55 | 0.05 0.08 |

Liquidity provision in extreme periods

Now we examine the resiliency of liquidity provision in periods of volatility and adverse market shocks. As both dealers and HFTs have no formal market making obligations, both may reduce their liquidity provision during periods of market stress. HFTs have a smaller risk-absorbing capacity than dealers, with smaller balance sheets and a tendency to hold positions over short time horizons. On the other hand, HFTs’ speed and superior technology may make them more able to manage increases in volatility.

We examine three types of adverse market conditions: 1) market-wide volatility, measured as a large (in the top 10% of the distribution) intraday spike in the VIX — an index of the implied volatility of options on the S&P500 index, 2) periods ahead of scheduled macroeconomic news announcements, significant announcements like ‘non-farm payrolls’ which have a significant impact on FX prices, and 3) an extreme stress period, the 2015 Swiss franc ’de-peg’ event.

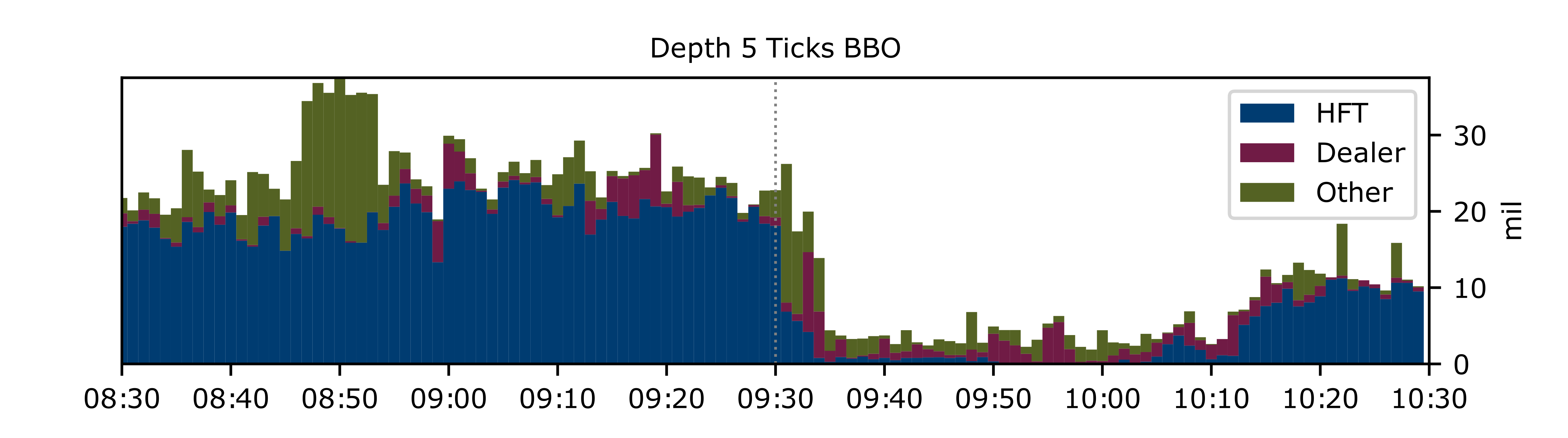

We find that HFT liquidity provision is less sensitive to spikes in market-wide volatility, while dealer bank liquidity is more robust ahead of scheduled macroeconomic news announcements. For the extreme stress period in our sample, we find HFTs withdrew their liquidity provision almost entirely, while dealers remained (see Figure 2 below).

In normal times, as HFTs are more successful at responding to ‘public information’ events (information which is symmetrically observable, see Aquilina, Budish and O’Neill (2022)), this may explain their greater ability to handle market-wide volatility. On the other hand, dealers may be more successful at managing ‘private information’ due to their broader client networks, which will be more ahead of macroeconomic news releases. In an academic context, ‘Private information’ refers to information about future prices. This can be generated by extracting the information embedded in the trades dealers undertake or from public information sources, such as analyst economic modelling or macroeconomic forecasts.

Conclusion

In this paper we examine the liquidity provision and price discovery roles of dealers and high frequency traders (HFTs) in the FX spot market. We find that HFTs, on average, provide more order-book liquidity than dealers. They quote a narrower bid-ask spread (better prices of orders) and supply more depth (larger size of orders) at the top of the order book.

We also find HFTs’ order-book liquidity provision is less sensitive to large market-wide volatility spikes. In contrast, dealers’ order-book liquidity provision is more resilient ahead of discrete single-security volatility, in the form of scheduled macroeconomic news announcements.

Whether the above findings hold during more extreme stress periods that are not in our sample, such as the 2020 COVID pandemic, is a question for future researchers. For example, anecdotal evidence we show from the 2015 Swiss franc ’de-peg’ event shows that facing extreme volatility, HFTs pulled out of the market altogether.

Overall, these results suggest that dealers and HFTs have different strengths at market making in the FX market. Dealers are likely able to derive more information from their large OTC client network or draw on their higher expertise and so are more able to manage periods of private information-asymmetry. HFTs with their faster and more advanced market-making algorithms, can better navigate market-wide high-volatility periods which involve comparatively larger amounts of public information revelation.