Our Guidance highlights the actions firms should take to understand the needs of vulnerable customers to make sure they are treated fairly.

Protecting vulnerable consumers is a key focus for us and is more important than ever due to the impact of coronavirus (Covid-19). Our Guidance aims to help firms ensure that they are treating vulnerable customers fairly, and includes examples of how to put this Guidance into practice.

Here, we provide a short summary of the Guidance.

2025 update

In March 2025, we published findings from our review of firms’ treatment of customers in vulnerable circumstances, as well as good practice and areas for improvement to support firms in delivering good outcomes for customers.

What we want to change

We want to drive improvements in the way firms treat vulnerable consumers and bring about a practical shift in firms’ actions and behaviour. We want vulnerable consumers to experience outcomes as good as other consumers and to get consistently fair treatment across the sectors we regulate.

We know some firms have made significant progress in how they treat vulnerable customers, including in their response to the pandemic. However, we have seen examples of others failing to consider the needs of these customers, leading to harm. It's important for all firms to understand the needs of vulnerable customers and make any changes required to meet the standards set by our existing Principles for Businesses (Principles).

Who are vulnerable customers?

A vulnerable customer is someone who, due to their personal circumstances, is especially susceptible to harm - particularly when a firm is not acting with appropriate levels of care.

Our view of vulnerability is as a spectrum of risk. All customers are at risk of becoming vulnerable, but this risk is increased by having characteristics of vulnerability. These could be poor health, such as cognitive impairment, life events such as new caring responsibilities, low resilience to cope with financial or emotional shocks and low capability, such as poor literacy or numeracy skills.

Our Financial Lives coronavirus panel survey, carried out in October 2020, demonstrates that more consumers find themselves in vulnerable circumstances due to the pandemic, with 53% of adults displaying a characteristic of vulnerability. This is an increase of over 3 million since February 2020, and many of these people may have multiple characteristics of vulnerability.

Not all customers who have these characteristics will experience harm. But they may be more likely to have additional or different needs which, if firms do not meet them, could limit their ability to make decisions or represent their own interests, putting them at greater risk of harm. So, the level of care that is appropriate for these consumers may be different from that for others.

Complying with our Principles for Businesses

Our Principles require firms to treat customers fairly and our Guidance makes clear what the standards set by our Principles mean for firms, so that firms understand what we expect of them. It sets out what firms should do to meet those standards. While firms are not bound to adopt or follow any of the specific actions described in this Guidance, they must meet the standards set by our Principles and treat customers fairly.

Because anyone can find themselves in vulnerable circumstances at any time, our Guidance is relevant to firms serving retail customers, including some business customers, regardless of the firm's size or sector.

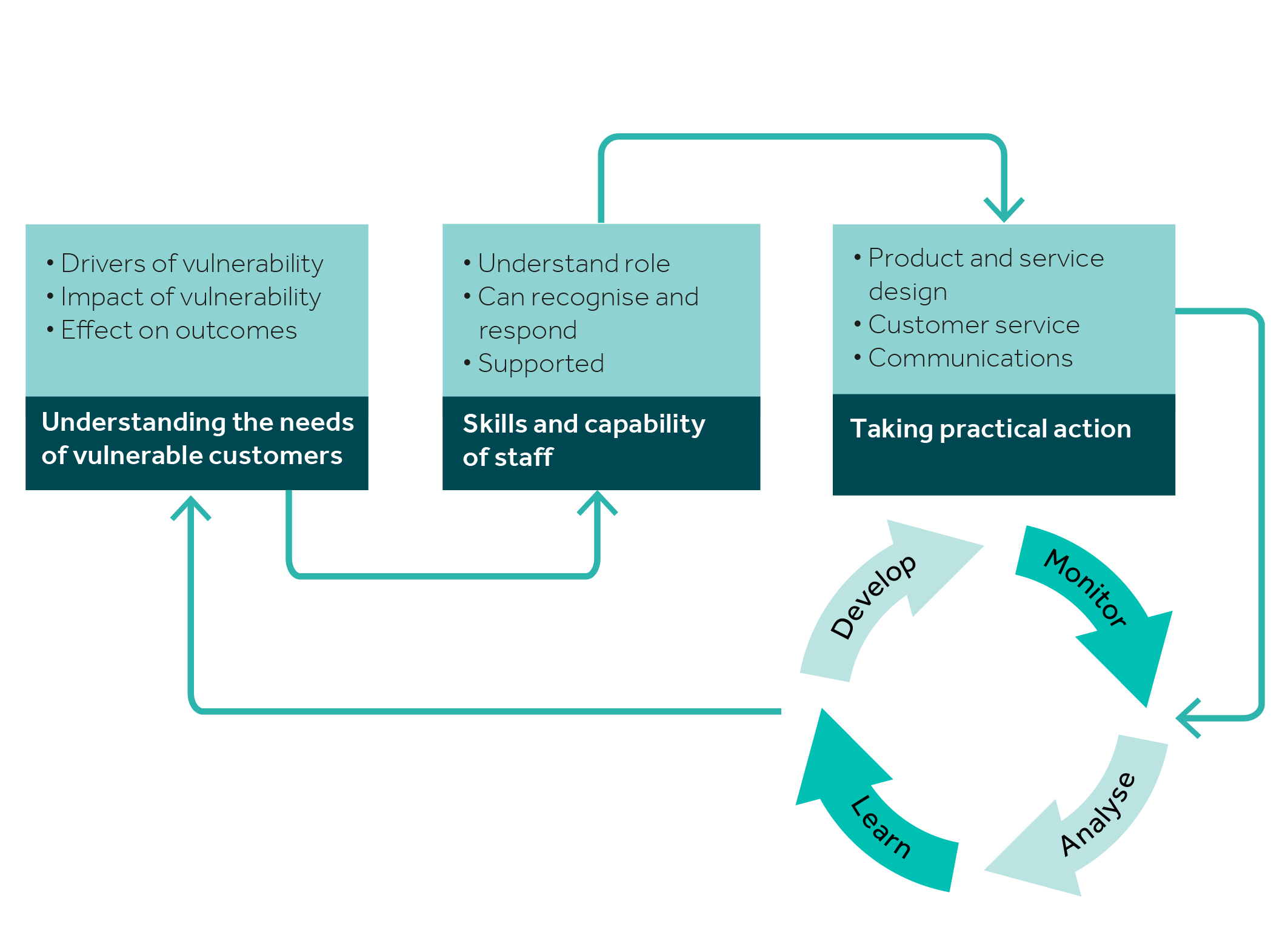

To achieve good outcomes for vulnerable customers, firms should take action to:

- understand the needs of their target market/customer base

- make sure staff have the right skills and capability to recognise and respond to the needs of vulnerable customers

- respond to customer needs throughout product design, flexible customer service provision and communications

- monitor and assess whether they are meeting and responding to the needs of customers with characteristics of vulnerability, and make improvements where this is not happening

(View the full version of our infographic)

Our Guidance sets out the actions firms should take in each of the above areas to treat vulnerable customers fairly. These are listed below. More detail on each of these actions, as well as examples of how firms can put them into practice and case studies showing good and bad practice, can be found in the Guidance.

We supervise and enforce against the standards set by our Principles. Firms can expect to be asked to demonstrate how their business model, the actions they have taken and their culture ensures the fair treatment of all customers, including vulnerable customers.

Actions firms should take to treat vulnerable customers fairly

Firms will need to use their judgement to consider what each section of the Guidance means for them and what they should do to make sure they treat customers fairly.

Understanding the needs of vulnerable customers

- Understand the nature and scale of characteristics of vulnerability that exist in their target market and customer base.

- Understand the impact of vulnerability on the needs of consumers in their target market and customer base, by asking what types of harm or disadvantage customers may be vulnerable to, and how this might affect the consumer experience and outcomes.

Skills and capability of staff

- Embed the fair treatment of vulnerable consumers across the workforce. All relevant staff should understand how their role affects the fair treatment of vulnerable consumers.

- Ensure frontline staff have the necessary skills and capability to recognise and respond to a range of characteristics of vulnerability.

- Offer practical and emotional support to frontline staff dealing with vulnerable consumers.

Taking practical action

Product and service design:

- Consider the potential positive and negative impacts of a product or service on vulnerable consumers. Design products and services to avoid potential harmful impacts.

- Take vulnerable consumers into account at all stages of the product and service design process, including idea generation, development, testing, launch and review, to make sure products and services meet their needs.

Customer service:

- Set up systems and processes in a way that will support and enable vulnerable consumers to disclose their needs. Firms should be able to spot signs of vulnerability.

- Deliver appropriate customer service that responds flexibly to the needs of vulnerable consumers.

- Make consumers aware of support available to them, including relevant options for third party representation and specialist support services.

- Put in place systems and processes that support the delivery of good customer service, including systems to note and retrieve information about a customer’s needs.

Communications:

- Make sure all communications and information about products and services are understandable for consumers in their target market and customer base.

- Consider how they communicate with vulnerable consumers, taking into consideration their needs. Where possible, firms should offer multiple channels so vulnerable consumers have a choice.

Monitoring and evaluation

- Implement appropriate processes to evaluate where they have not met the needs of vulnerable consumers, so that they can make improvements.

- Produce and regularly review management information, appropriate to the nature of their business, on the outcomes they are delivering for vulnerable consumers.