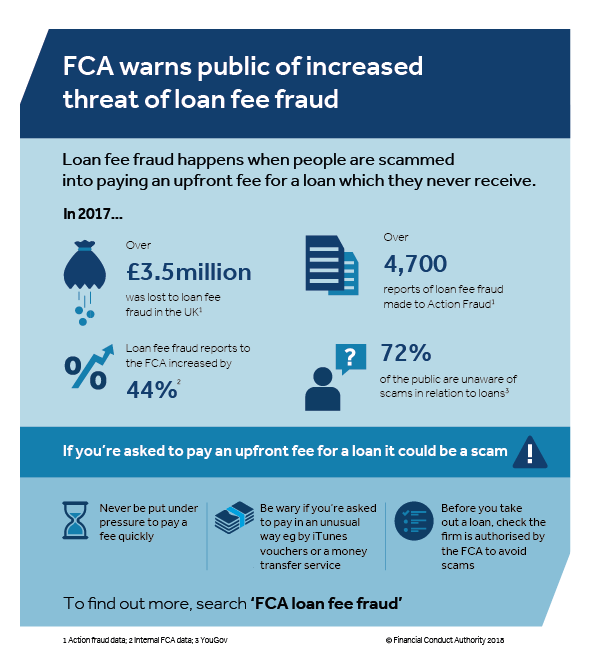

- Over £3.5 million was lost to loan fee fraud in 2017

- Loan fee fraud reports to the FCA increase by 44% from 2016 to 2017

- 72% of the public are unaware of scams in relation to loans

The Financial Conduct Authority (FCA) is today urging the public to be alert to the growing threat of loan fee scams targeting borrowers. This plea comes as last year over £3.5 million* was lost to loan fee fraud and reports to the FCA consumer helpline increased by 44%**.

Victims of loan fee fraud are often targeted while searching for loans online and are then contacted by fraudsters offering a loan. The scammer tells the victim they have to pay an upfront fee for the loan which they ultimately never receive. Once the first payment is made victims are often persuaded to make multiple payments – last year the average loss was £740*.

Mark Steward, Executive Director of Enforcement and Market Oversight, FCA, said:

'We’re seeing an increasing number of cases of loan fee fraud reported to us. Fraudsters target people making online loan applications and who think they’re being contacted by a legitimate loan provider, when they are not at all.

'Scammers take advantage of the excitement people feel when they are offered or accepted for a loan and make the loan conditional of an upfront fee, which can increase to hundreds of pounds. Of course, no loan ever materialises.

'Before applying for a loan always check who you’re dealing with, be sceptical, make sure the loan provider is authorised by the FCA. Check our register at fca.org.uk.'

In 2017 there were over 4,700 reports of loan fee scams made to Action Fraud. Additionally, it has now overtaken investment fraud as the most common scam reported to the FCA. Scammers target the most financially vulnerable in society, people on lower incomes and with low credit ratings, who have limited access to mainstream credit.

New FCA research shows that 34% of those surveyed admitted they weren’t confident they knew how to check if a loan provider was legitimate. Additionally, 36% of those who took out a loan product in the last three years didn’t do any checks to ensure the legitimacy of their loan provider.

There are legitimate loan brokers who charge fees in advance of providing their services and are authorised by the FCA. However, being asked to pay a fee before receiving a loan can be a warning sign of this type of scam. To avoid scams it’s vital for consumers to check they are only dealing with authorised firms from the FCA register.

Research shows that over a third of people (36%) usually just accept what financial firms tell them. Fraudsters take advantage of this attitude and have a range of genuine sounding reasons for asking for a fee - including claiming it’s a deposit, admin fee or insurance for those with low credit ratings. Other warning signs include:

- being asked to pay in an unusual way e.g. by iTunes vouchers or a money transfer service

- being put under pressure to pay the fee quickly

- being asked to pay multiple fees

The FCA is encouraging the public to be wary if asked to pay an upfront fee for a loan as it could be a sign of a scam. The regulator is also urging people to only use authorised firms which you can check on the FCA’s online register. It’s important to make sure the contact information provided by the firm match the details on the register to ensure you’re dealing with the real firm.

The FCA assesses every loan fee fraud report received and will issue public warnings about unauthorised firms that breach our rules and target UK consumers. For unauthorised firms and individuals operating from within the UK, the FCA has a wide range of enforcement powers to protect consumers. These include taking civil court action to stop illegal activity and for the most serious cases, pursuing criminal prosecution.

Notes to editors

- *Figures from Action Fraud.

- ** Figures from FCA Contact Centre, 888 reports in 2016 and 1276 reports received in 2017.

- All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 2016 adults. Fieldwork was undertaken between 27th - 28th March 2018. The survey was carried out online. The figures have been weighted and are representative of all GB adults (aged 18+).

- On 1 April 2014, the FCA took over the regulation of consumer credit from the Office of Fair Trading. It introduced new rules for credit brokers in 2015. In particular, firms must make clear that they are a credit broker (not a lender) and so cannot guarantee a loan. In addition, any broker charging an advance fee must provide an ‘information notice’ stating that a fee will (or may) be charged, and the amount, and must get formal confirmation from the consumer before taking payment or asking for payment details. Failure to do so is a breach of FCA rules, and can lead to enforcement action.

- Suspected loan scams can be reported to the FCA via the contact centre on 0800 111 6768. Fraud should also be reported to Action Fraud on 0300 123 2040 or at www.actionfraud.police.uk.

- On 1 April 2013, the FCA became responsible for the conduct supervision of all regulated financial firms and the prudential supervision of those not supervised by the Prudential Regulation Authority (PRA).

- The FCA has an overarching strategic objective of ensuring the relevant markets function well. To support this it has three operational objectives: to secure an appropriate degree of protection for consumers; to protect and enhance the integrity of the UK financial system; and to promote effective competition in the interests of consumers.

- Find out more information about the FCA.

Download PDF version of infographic