Our research found that consumers of debt management services often have multiple and high levels of debt. Read about consumer behaviour and market size.

This page was published in 2015.

Consumer behaviour and experiences

Our consumer research found that consumers of debt management services:

- often have multiple and high levels of debt, ranging between £500 and £100,000, with the majority having debts of £15,000 to £30,000

- sought help for various reasons, including income shocks or gradual build-up of debt, making debt repayment unmanageable

- rarely shop around and rely heavily on recommendations, adverts and basic internet searches

- often urgently need help and are happy and relieved when faced with someone who understands their situation

- have very limited knowledge of the market and the products and services available to them, and so put a lot of trust in debt management providers and find it difficult to ask the appropriate questions

Key features

Though there is some uncertainty, there are various estimates that give an indication of the size of the debt management sector.

Grant Thornton, for example, estimated that at the start of 2012 there were between 520,000 and 645,000 debt management plans ongoing, with between 300,000 and 375,000 of these provided by fee-charging debt management firms. They also estimated that there were between £12.8 billion and £15.2 billion debts outstanding being managed in debt management plans at the start of 2012.

In early 2010, the OFT estimated that consumers would pay £250m in fees to debt management firms over 2010. While in their 2012 report, Grant Thornton estimated that between £149m and £186m had been earned in fees from debt management plans in 2011.

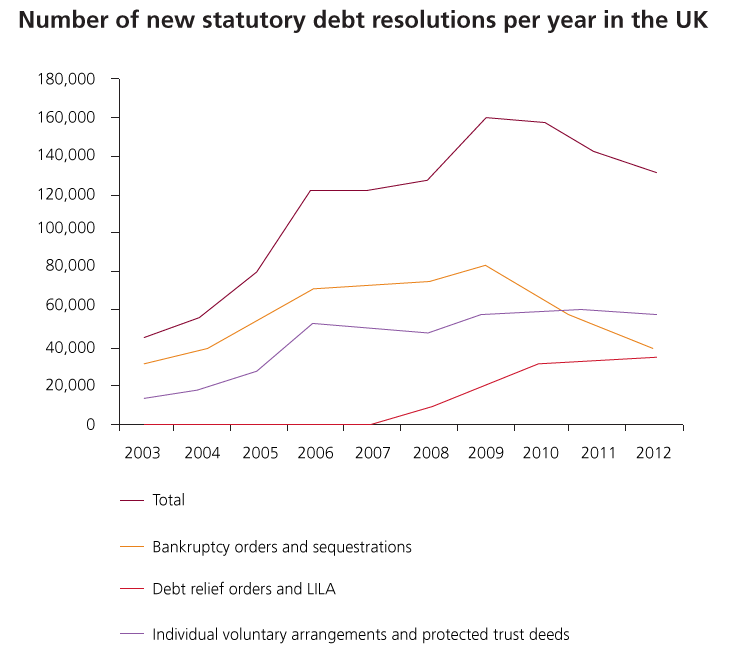

There is also evidence of growth in the number of debt solutions in the years following the financial crisis. For example, statutory debt resolutions peaked in 2009 (just after the financial crisis) and have since fallen. There were 102,000 in 2009 and 75,000 in 2012 (The Insolvency Service 2014).