Our research shows that most credit cards have a complex combination of features, fees and interest. Find out more about the key features of this market.

This page was published in 2015

Credit cards have many useful functions including:

- Credit cards can be used to cover an unexpected cost until the next payday or to spread a large cost over a longer period.

- They are widely accepted and secure, which makes them very convenient.

- Certain purchases are more protected if made with a credit card.

- Unlike most other forms of credit, users have flexibility in how much of the outstanding balance they pay each month. They must pay a minimum amount or they incur a penalty charge, and if they do not pay the balance in full at the end of a month, they are charged interest.

- In recent years, there has been a growth in the number of credit cards with 0% balance transfer deals, providing a popular way for consumers to keep the costs of servicing their debt low.

Some consumers use credit cards as a way to build their credit histories.

Key features

Key features include limited-time 0% deals on balance transfers and 0% purchase deals.

Fees can include:

- annual fees

- balance transfer fees

- default fees

- fees for cash withdrawals

- foreign transaction fees

Alternatives to credit cards include charge cards, which are like credit cards but whose balance must be paid in full monthly.

Another alternative is a store card, which can only be used with a particular retail group, unlike credit cards which are widely accepted. They typically have lower limits and provide rewards for spending with that retailer.

Debit cards can be used in similar ways to credit cards when they draw on an overdraft. We have also published findings from our research into overdrafts.

Some cards are aimed at specific consumer groups. Some give rewards for use, such as cashback on purchases.

There are also ‘low and grow’ or credit builder cards aimed at subprime borrowers or those with little or no credit history. These start with a low limit that is gradually raised as the borrower proves their credit-worthiness.

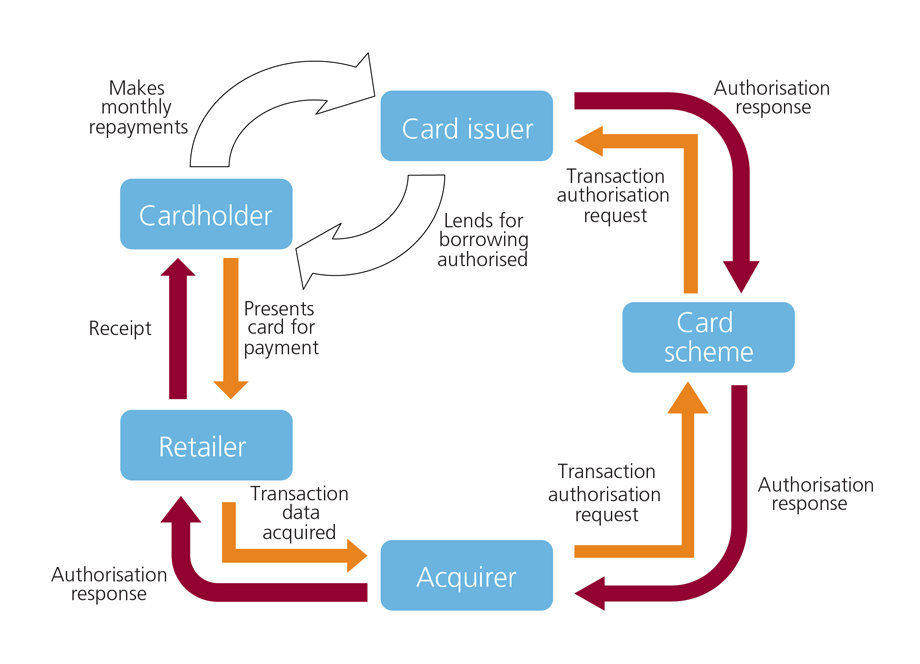

Credit cards are also an important means of payment. A range of different firms play a role in relation to credit card payments:

- Issuers are members of a card scheme (e.g. Mastercard, Visa) to which the credit card they have issued is tied.

- A retailer can accept credit cards from one or more card schemes and is often obliged to accept all cards issued by the scheme (Honour All Cards Rule).

- If a consumer holds a card from a scheme the retailer accepts, they can make a credit card payment to that retailer.

- When a credit card payment is attempted, the card issuer decides whether to authorise the payment.

- If the payment is authorised, the acquirer, which acts as a ‘go between’ between a retailer and the issuer, acquires the transaction and pays the retailer for the goods or services purchased by the consumer at contractually agreed times.

- The card scheme sits above both the issuer and acquirer and connects the issuers and acquirers in the scheme.

- The issuer remits the amount spent by the consumer to the acquirer for the credit card payment.

- The consumer then owes the payment amount to the card issuer (in addition to any balance outstanding they already had).

When a credit card payment is made the acquirer is charged an interchange fee by the issuer which the acquirer then charges to the retailer (so essentially the retailer pays the interchange fee to the issuer). The level of the interchange fee is set by the card scheme.

Credit card payments and credit: adapted from UKCards

Actions that affect payment services and systems, including the possible cap on interchange fees, may have an impact on dynamics in this market.

Market size

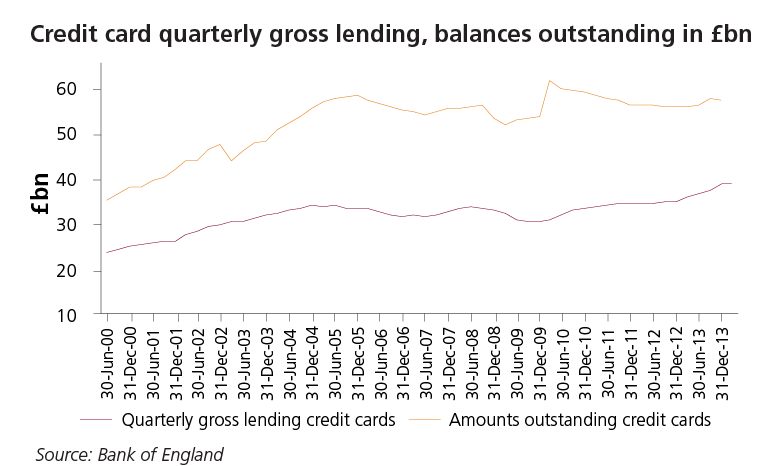

UK adults borrowed £150bn on credit cards in 2013 (Bank of England) . Though a large amount, much of this debt was repaid within the year and a large amount of it was on purchases that were paid off without incurring interest.

Currently consumers owe £56.9bn in credit card debt (Bank of England). Around 40% of this debt incurs no interest (UKCards), from consumers who pay off their balances every month and from those on 0% balance transfer and 0% purchase deals.

Market trends

Before 2005, gross lending on credit cards generally exceeded repayments, leading to persistent growth in balances outstanding.

In 2005 there was a dramatic change, repayments increased significantly, leading to a fall in credit card debt. Between 2005 and 2012, gross lending was flatter though net lending remained generally positive, although much lower than it had been before 2005.

The large increase in credit card write-offs following the crisis, as lenders tightened credit conditions and cleared the worst performing card debt from their loan books, led to some falls in balances outstanding.

Since mid-2012, net lending has grown. With the level of write-offs continuing to fall, the balances outstanding have also begun to grow again.

With the more positive economic outlook and the continuing squeeze on household finances, we expect this growth in credit card debt to accelerate.