Intergenerational differences have long been recognised and reflected in the FCA’s priorities. The recent Discussion Paper on Intergenerational Differences considered the financial needs and circumstances of each generation, and our recent Feedback Statement summarised responses to this.

The generations are often categorised into four groups:

- Generation-Z (born since 2000)

- Millennials (born between 1981 and 2000)

- Generation-X (born between 1966 and 1980), and

- Baby Boomers (born between 1946 and 1965)

In line with the approach of the Discussion Paper, this article focuses on the three main generations by population size for this analysis. However, given the especially severe health impacts of Covid-19 on the oldest cohort, born before 1946, and the interlinkages between health and financial need, we will continue to specifically monitor the data available for this group.

The different financial lives of these groups and the distinct challenges they face have become familiar to many. Millennials struggling to buy their first home amid high price-to-income ratios. Mortgaged Gen-Xers sandwiched between responsibilities for their parents and their children. Baby Boomers, many of whom enjoy relative affluence, but many of whom are also among the digitally excluded or working through difficult financial choices for their retirement.

We must of course begin with a caveat – these generational groups are not homogeneous. There are affluent home-owning Millennials just as there are Baby Boomers with little wealth or income, living in rented accommodation. We cannot assume that their long-term needs, and indeed priorities, are all the same.

But, on average, previous analysis has identified clear patterns in the needs of different generations, the headwinds each faces, and in the challenges policymakers and regulators must address to support each.

The FCA Discussion Paper, developed prior to the Covid-19 outbreak, highlighted several intergenerational issues to which the financial industry and regulator have a common role in responding.

The pandemic is already impacting people financially and may be shifting the picture on intergenerational differences. It is much too early to be definitive about the precise implications of the current crisis. But we can outline some of the parameters.

Whilst no-one is ‘safe’ from Covid-19, the tragic health impacts have been concentrated on the most physically vulnerable, and especially older people.

Likewise, given their different needs and starting points, the economic effects are not the same on every generation. Recent empirical evidence is revealing how Covid-19 is adding a new dimension to intergenerational differences.

So far, the data indicates that the crisis is delivering a particularly severe financial blow to younger earners. They are just starting out in careers in many cases and, as a generation, are facing the biggest brunt from loss of work and impaired future employment prospects. But older workers who are not yet retired have also been impacted disproportionately and some are now confronting real financial hardship and challenges ahead. The emerging picture on Covid-19's impact underlines how important the intergenerational lens is to understand how the financial services industry can best adapt to meet the needs of each cohort throughout their financial lives.

Work and earnings

Social distancing measures introduced to combat the spread of the Covid-19 virus have resulted in large parts of the economy effectively being shut down. The associated earnings shock is unprecedented.

Younger generations are more likely to work in the sectors most severely impacted by the crisis and face the greatest challenges in emerging from lockdown. Hospitality, the care sector, retail and indeed the service economy in general are far more dependent on face-to-face interactions. On the other hand, older cohorts working in these sectors may find it harder to secure opportunities to re-train.

The FCA recently surveyed a representative sample of 8,000 UK adults aged 18-75 on their experiences in relation to the Covid-19 crisis, including in relation to loss of work and pay, as well as their expectations for recovery. Fieldwork was undertaken during May 2020 and the survey was carried out online.

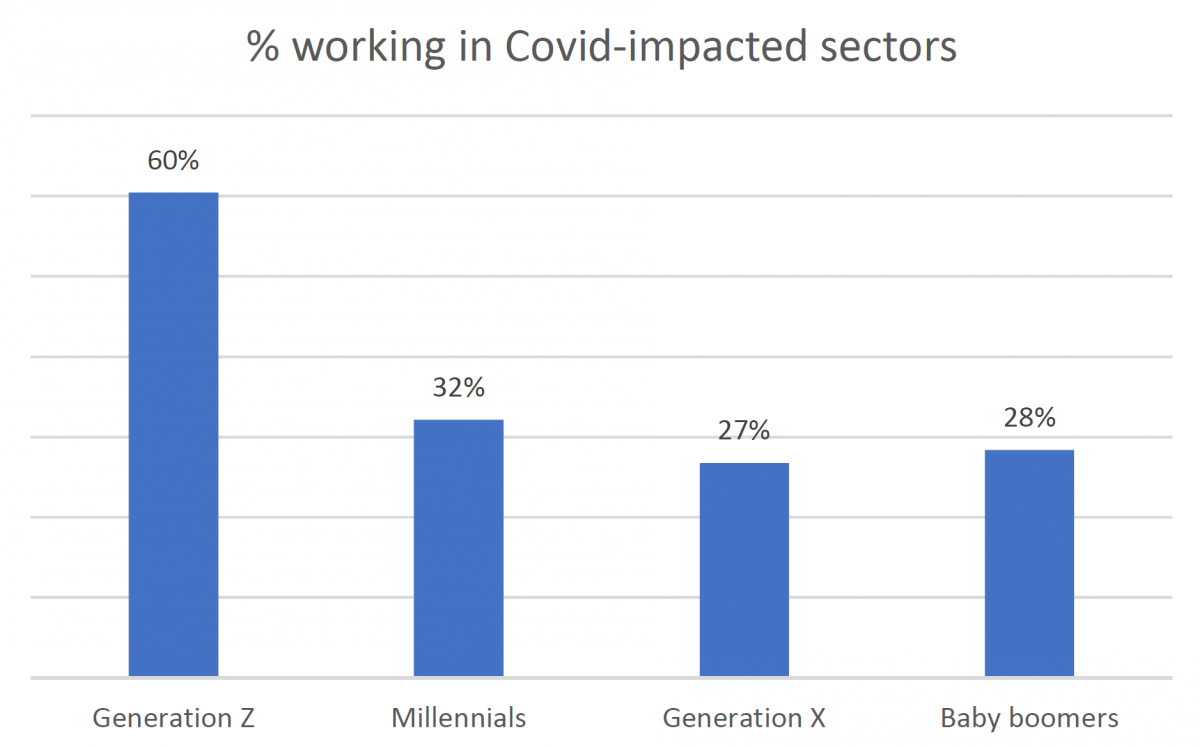

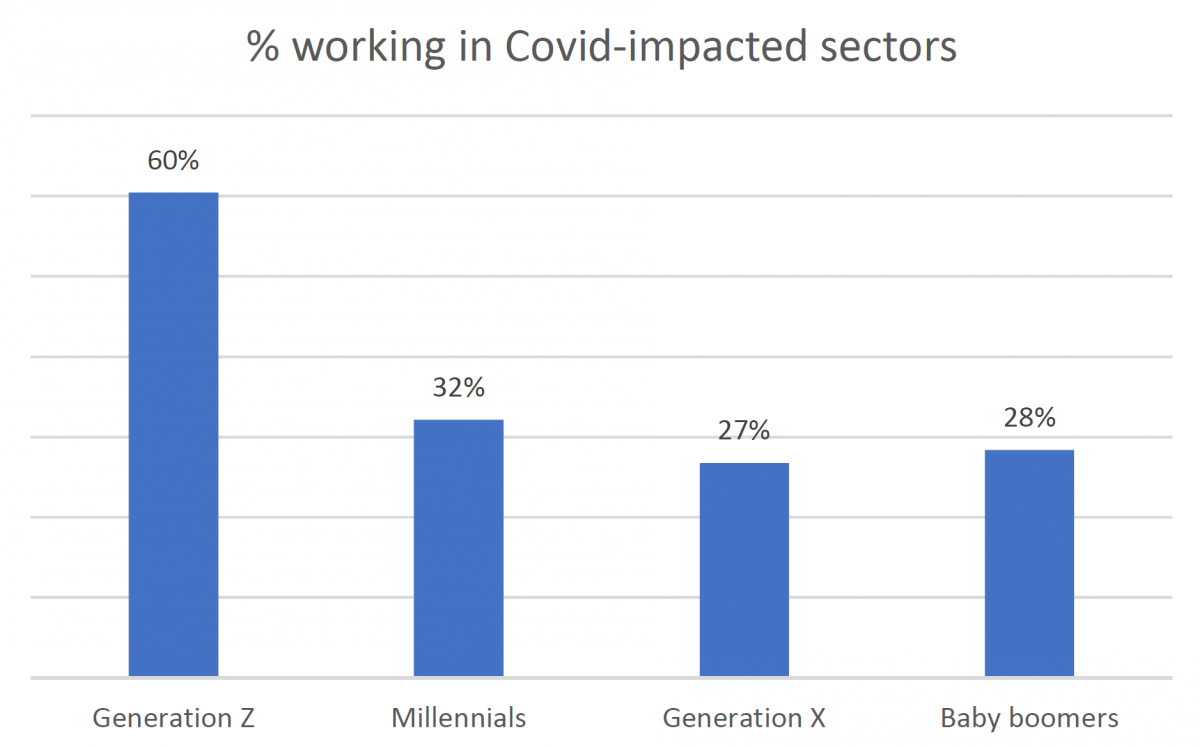

A higher proportion of Millennials and Generation-X in our survey reported working in ‘Covid-impacted’ sectors, consistent with findings from other recent studies. Using the Office for National Statistics Business Impact of Coronavirus Survey (BICS), we define ‘Covid-impacted’ sectors as those with the highest percentage of businesses pausing trade or temporarily closing due to Coronavirus related restrictions.

Further evidence is found in data on earnings impact and job loss.

The Understanding Society project launched by the National Institute of Economic and Social Research in 2009 is the largest longitudinal study of its kind. Its latest special survey on the Covid-19 outbreak (end May 2020) was based on a sample of 15,000 UK adults and reveals significant intergenerational differences.

Looking first on employees, the study shows that it is younger and older works—the Millennials and the Baby Boomers—that are most likely to have experienced an impact, whether through furlough, hours or pay lost or lost jobs.

Baby Boomers and Millennials are more than twice as likely as Generation Xers to have lost their jobs altogether during the pandemic.

We can further analyse these effects by considering different types of employment. Those in atypical employment – without fixed weekly hours – have been most affected by the crisis, and again we note that both Millennials and Baby Boomers are somewhat more likely to be employed in this way (21% in each case, compared to 18% for Gen-X).

Among those without fixed hours we see the same broad pattern, but the differences between the generations is more marked.

As the chart below indicates, 44% of Millennials and 49% of Baby Boomers without fixed hours have either been furloughed (29% of Millennials and 32% of Baby Boomers), lost hours and pay (5% and 10% respectively), or lost their job (10% and 7%). By comparison, around a third of Gen-X employees have been affected in one of these ways.

For some, atypical employment may reflect a choice to work more flexibly to supplement other sources of income or support – for instance, some Baby Boomers may use non-fixed hours employment to supplement retirement income. As such, some in this group may be more insulated from the economic effects of the crisis. However, there will be important variation in the overall picture and the welfare impact of a loss of earnings at an individual level.

Among employees who have suffered an earnings fall, the magnitude of the impact also differs by generation. Millennials and Baby Boomers have experienced somewhat larger falls, with those impacted seeing a 19% and 23% drop in earnings on average compared to a 17% average fall for Gen-X employees.

What about the self-employed?

Between 10% and 17% have lost hours and earnings, and 5-6% stopped trading. But a very large further proportion of the self-employed have needed to use the Self-employment Income Support Scheme, which since 13 May 2020 has provided income support of 80% of average past profits for self-employed workers affected by Covid-19.

The group that has been effected in one of these ways are the self-employed Millennials.

Self-employed workers have also suffered the deepest cuts in earnings, with an average earnings fall among those impacted of over 60%. Here, however, the differences across generations are less pronounced.

In overall terms then, it is the older and younger generations, and particularly Millennials, who have experienced the strongest effects of the crisis so far in relation to work and earnings.

Looking ahead we note some differences between generations in their perceptions of unemployment risk in the near future.

The FCA survey found that Millennials were more pessimistic about the risk of losing their own jobs in the next 3 months, estimating this risk to be 27%. Among Gen-X-ers and Baby Boomers the corresponding estimates were lower at 23% and 22%.

Financial Resilience

Latest data from the FCA Financial Lives survey allows us to gauge financial resilience across the generations prior to the Covid crisis. It includes questions about whether consumers had fallen behind on bills and credit payments prior to the crisis, to what extent bills and credit repayments had been a heavy burden, and how long consumers could have continued to cover living expenses had they lost their main source of family income.

On these terms, we estimate that 26% of Millennials entered the crisis with low financial resilience, compared with 23% of Gen-X and just 13% of Baby Boomers.

In other recent work, we analysed large-scale credit file data drawn prior to the crisis for a representative sample of 2.6 million UK adults. We calculated a measure of liquid funds from estimates of the cash balance in each individual’s current account, plus unexhausted limits on any credit cards and overdrafts. This confirmed a clear difference by generation, with older generations enjoying a better financial cushion.

That older generations have on average a bigger financial cushion is, of course, hardly news. However, it is one of the factors that may mean the economic fall-out from the crisis is felt more severely by younger generations, making it more difficult for them to accumulate assets and ‘catch up’ in the future.

What is more, there is a generational correlation between those who entered the crisis with poor financial resilience and those who have suffered job loss or a blow to earnings since. We found that 30% of Millennials who have suffered a loss of job and/or earnings since the crisis began already had low financial resilience heading into the pandemic compared to 17% of Gen-X and only 6% of Baby Boomers.

Heading into the crisis, younger people were also much more likely to be in a precarious position in debt terms. Previous FCA research found that the young are disproportionately more likely to fall into arrears and to be users of high-cost credit products— further markers of stress and low financial resilience.

Before the crisis about 1 in 7 Millennials were in arrears on one or more of their debts. Since the onset of the Covid crisis that figure has risen to 1 in 5.

Note: Based on FCA survey and authors’ calculations.

As these graphs show, there has also been a rise in arrears among Baby Boomers, albeit the impact on them still remains smaller than for younger cohorts.

But this is a timely reminder that these generational groups are not homogeneous. So while on average Baby Boomers have higher incomes and savings, there are older consumers who do not have this security and are now in new financial difficulty.

Differences in Deferrals

One of the key responses of the FCA to the Covid-19 pandemic has been to require firms to give borrowers who hve been adversely affected by the crisis the option to defer repayments on mortgages and consumer credit products for a temporary period.

The take-up of these relief measures provides an additional lens on stress, and gives some sense for where pressures are being felt most acutely and therefore how the needs of each cohort are evolving.

And again we see a difference between generations.

As the graph below from our survey shows, use of payment deferrals has been more common among younger generations. This is true for mortgage deferrals and even more so for consumer credit deferrals.

Note: FCA survey and authors’ calculations. The base is the number of respondents within each generation that hold the debt type in question – either a mortgage or any consumer credit product (with positive balance).

A financial burden on Millennials?

The most severe health toll of Covid-19 has fallen sharply upon older generations as the now familiar and tragic mortality statistics have shown.

But from an economic and financial perspective the cost of Covid-19 is falling disproportionately on the young.

They entered the crisis on average with lower financial resilience, and face unemployment and debt difficulties in greater numbers. They are also more likely to be using payment deferral schemes to keep their heads above water in the short term.

The FCA’s recent Covid-19 survey showed they are also bracing for more difficulties in the immediate future. Asked whether they expected to face negative financial outcomes in the next six months, Millennials and to a lesser extent Gen-X were far more likely to answer ‘yes’. Across a range of measures - from expected debt arrears to household budgeting, expectations about the need to cut back on essential spending and, even about potential future food bank use - younger consumers are more likely to be anticipating challenges.

To reiterate, the fact that younger individuals and households earn less, own less, and overall have a smaller financial cushion is not unexpected. But we must recall that, heading into the crisis, younger generations on average were already enjoying less financial security than their parents at a similar age. This data therefore points to the needs and circumstances of each generation continuing to be different, raising questions in relation to how industry and the FCA can best address their needs.

Looking forward

So far, we have only a snapshot of the immediate effects of the crisis. The medium and longer-term effects are harder to assess and may hinge upon as-yet unforeseeable events in the wider economy, and on the public policy response such as the ‘Kickstart Scheme’ aimed at helping 18 – 24 year olds affected by the crisis into employment.

However, given potentially profound changes on both the supply side and the demand side, including potential shifts in consumer preferences, decision-making and behaviour, the unknown unknowns are legion.

The trajectory for recovery remains unclear and just one factor to consider is the uncertainty in asset prices.

The outlook for financial markets is uncertain from interest rates to equity returns. What might the effects be over the next few years on the pension pots of those approaching retirement or already in drawdown? Figures from HMRC show a sharp rise in pension withdrawals already and some of this may reflect people furloughed or laid off and needing to access to cash or concerns about stock market volatility and a desire to move money into perceived safer havens. Of course there are also potential risks to early pension drawdown.

Meanwhile Millennials have faced a long struggle with the housing market, finding it far harder than their parents to buy their first home. What will now happen to house prices and mortgage availability? What might happen to the demand for homes in previously popular areas if working from home becomes a longer-term reality for many?

The emerging Generation-Z

Many of Gen-Z will come of age and enter the workforce during what could be the deepest global recession since World War II. They may face particular challenges as a result. We know from previous crises that the effects of unemployment are most severe for those who have entire working lives ahead of them; they may suffer long-term impairment to their employment and earnings prospects. Previous academic research has also found evidence that macro-economic experiences can have a lasting effect on risk-appetite, with those experiencing a depression early in life less likely to invest in the stock market and take financial risk decades later.

On the other hand, the young have full working lives in front of them and time to adjust and adapt to the shock. An important factor in avoiding disruption to longer-term plans and welfare of particularly younger cohorts will be the ability to smooth consumption over time and here credit markets have a key role to play.

The FCA has a significant part to play in ensuring these markets function well and can support the needs of different consumers as these evolve through the crisis and beyond.

The crisis has also brought forward innovation in working models and practices with many workers finding themselves able to adapt to work more remotely and flexibly, empowered by technology. This step change could deliver value for many years to come, with the young most able to reap gains from this over the longer run.

Few of us will emerge from this crisis untouched, whether in terms of health or finances. But it is equally clear that the effects differ by generation, from the most direct impacts through to second-order implications.

Policymakers and regulators are already highly alert to the need to understand and address intergenerational issues and to support markets to respond to these effectively. While it is too soon to say what the full impact of Covid-19 will be, it seems likely that the crisis will add further gravity and complexity to the challenge, with the clear potential for the pandemic to exacerbate the patterns of difference between generations which have emerged over the past 30 years.

Approaches to addressing these issues could include developing hybrid and flexible products to meet the evolving needs of the young, whilst also providing additional support in managing the higher degree of risk across generations and the specific risks that each cohort faces.

As the FCA’s Feedback Statement sets out, there is a need for both the FCA and the financial industry to do more to adapt and innovate to meet the needs of each generation.

Additional co-authors: Teresa Bono, Jesse Leary, Prudence Leung, Wenjin Li, Sean de Montfort