Previous Insight articles have investigated this with regards to ethnicity and health. In this third article, we take a look at gender. We look at a picture of financial services before the pandemic. We highlight gender differences in product ownership and the different levels of confidence in dealing with financial services between men and women.

We also look at the different types of actions taken to cope with changes in financial position in response to the Covid-19 pandemic, between March and October 2020. Where appropriate we estimate pre-pandemic differences between consumers by gender in terms of their use of financial services and products.

As well as describing this picture we also show results of our initial modelling using logistic regression to control for differences in factors such as age, ethnicity, and income, so as to focus on the impact on differences in gender alone.

We recognise that some people prefer to self-define their gender and some reject a binary definition. For these adults, our survey data is of limited sample size and so does not allow for analysis of statistical differences. Therefore, in this article we focus on differences between men and women.

The varied impacts of Covid-19

The economic impact of the Coronavirus pandemic is not equally distributed amongst all adults and where inequalities existed before the pandemic these may have been widened or closed. Different circumstances before the pandemic will also influence people’s ability to survive financially and to recover in the aftermath.

Before the Coronavirus pandemic, statistical differences were visible between men and women in the UK; key ones being life expectancy and income. The Office for National statistics data shows that life expectancy is higher for women than for men, but women earn less.

In April 2020 the gender pay gap was 7.4%. Further a higher proportion of men than women were in employment in 2020. In addition to these differences the FCA’s Financial Lives survey shows that before the pandemic a higher proportion of women than men displayed characteristics of vulnerability – 51% compared to 40%. The gap was greater between women from ethnic minorities and men from ethnic minorities – 56% and 44% - compared to the gap between White women and White men – 51% and 44%.

The pandemic has had a different effect on men and women. FCA surveys show that overall, one in three (31%) UK adults experienced a drop in their household income between March and October 2020. But the way in which income was reduced differed. Among those working for an employer at the end of February 2020, a higher proportion of men than women have had their hours or pay cut (20% vs 13%, respectively). Marginally fewer women than men have been furloughed or put on paid leave (26% vs 28%, respectively).

However, in the period between March and October 2020, there were no real differences between the proportion of women and men who say they have reduced their working hours to care for children or others, or stopped work to become full-time carers (4% for men, compared with 5% for women). That said, 9% of single parents (62% of whom are women) say they have had to cut their hours or stop working to care for children or others.

As well as reporting on the difference between how many men and women own different products, or have seen changes in income etc, for parts of our analysis we seek to control for other factors - such as age, ethnicity, and income - so we can determine whether gender itself is important in understanding why these differences exist.

Women tend to score themselves as being less confident and knowledgeable about financial services

The FCA’s Financial Lives survey asks people to score themselves against a range of confidence measures and their attitude to risk. The chart below shows the proportion of people who score themselves low (0-6 on a scale of 0-10) or agree or disagree with certain statements.

Source: Financial Lives survey 2020 – Base: All UK consumers (16,190), excluding ‘don’t know’ responses

Results show that the levels of men and women who say they have low satisfaction with their own financial circumstances are similar. But there are some clear difference in their confidence in relation to financial matters and their levels of risk aversion, including:

- Men feel more comfortable dealing with financial services than women.

- A higher proportion of women say they have low confidence in managing money or knowledge of financial matters.

- Women appear to be more risk averse in the way the manage their finances.

Some of these aspects - having low confidence in managing money, low knowledge about financial matters, or not seeing themselves as a savvy consumer - are used to determine whether or not someone has ‘low financial capability’ – one of the four drivers of vulnerability used by the FCA.

The results of our initial modelling show that, when we control for other factors, gender has no significant relationship with whether consumers have low financial capability. The biggest predictors are age, income, and highest level of qualification achieved. Perhaps unsurprisingly those with no qualifications are nearly twice as likely to have low financial capability as those who have a postgraduate qualification.

So, while a higher proportion of women say that they have lower levels of confidence and knowledge, our initial modelling shows that gender is not an important factor in these subjective levels of confidence.

Similar to what we found in our analysis of the impact of Covid-19 on ethnic minorities, this suggests that underlying differences such as income and education mean that a higher proportion of women report lower levels of confidence and knowledge about financial matters.

Differences in the types of financial products owned

Before Covid-19 there were significant differences in the type of products owned between men and women.

Source: Financial Lives survey 2020 Base: All UK consumers (16,190)

The chart above shows that a higher proportion of men own most types of financial product, perhaps reflecting higher levels of confidence around finances, as well as the gender pay gap and employment rates highlighted above.

The glaring exception to this is in the ownership of certain consumer credit products – this is interesting as results show that men feel more comfortable using credit though appear to be less likely to use it. We now look at each group of products in turn, highlight the pre Covid-19 differences and how things have changed since the pandemic began.

Banking

There is no difference between men and women when looking at access to a current account (97%). However more men have an e-money alternative account - 5% compared to 3% of women. Further, a higher proportion of men use contactless payments. In the 12 months up to February 2020, 86% of men used contactless compared to 83% of women.

In terms of using technology to manage finances, a key area is open banking. An open banking style app allows the user to see the accounts they hold with different banks in one place or build savings by monitoring different current accounts and automatically transferring funds.

Currently there is no difference in use between men and women (both 8%) in using this technology. However, there is a difference in trust. Women are less likely to be willing to allow their bank to securely access their banking information for open banking – 69% of men exhibit low willingness compared with 76% among women. This lower trust among women may have an effect on future take up.

Levels of reliance on cash have been similar for both women and men. Pre-pandemic 11% of women were likely to rely on cash to a great extent compared with 9% of men.

Access to cash has been one area where the pandemic has had a marked effect that has differed between genders. Since the end of February 2020, two out of five (40%) men who were heavily reliant on cash in February have found reduced access to bank branches and ATMs since Covid-19 began to be a major inconvenience compared with a third (32%) of women.

As well as access to cash there is a difference between genders in their experience of whether businesses will accept cash payment. Among men who were heavily reliant on cash in February, 41% reported that fewer businesses accepting cash had been a major inconvenience. Among women the figure was lower at 34%.

General insurance and protection

Product ownership figures show little difference between genders before the pandemic began. A widely reported issue during the pandemic has been clarity and coverage of insurance policies and difficulties making claims.

Looking at customer experience, there is little difference in experience by gender in terms of having trouble getting a refund from an insurance company or reporting that a claim has been handled poorly (4% of men, 3% of women).

There is also little difference in the number of insurance and protection policy holders that have cancelled a policy during the pandemic in order to save money – 7% of men and 6% of women.

Savings, investments and pensions

There are some small differences in the ownership of savings products. A higher proportion of women own a cash ISA (37% vs 35%) rather than more risky investments, potentially reflecting a lower risk appetite. When we control for other factors, the strongest predictor of having any savings account was being retired or semi-retired.

However, when we control for other factors, gender had a significant relationship with having a savings account. Women were 1.3 times more likely to have a savings account than men.

When it comes to investments, a higher proportion of men hold investment products. The largest differences are stocks and shares ISAs (19% of men compared with 12% of women) or shares and equities (26% of men compared to 17% of women). Further, controlling for factors such as age, income and ethnicity, men are more likely than women to have any investment product.

Among those who had investments at the end of February, a higher proportion of men have made a change to their investments during the pandemic: 12% of men have moved money from investments into cash savings compared with 8% of women.

A greater proportion of men have also withdrawn money from their investments to support income (16% of men compared to 14% of women) and more men have withdrawn money from investments to make essential purchases – 14% compared to 12% of women.

Looking now at pensions, before Covid-19 a higher proportion of men have private pension provision – 79% compared to 70% among women. When we control for age, ethnicity, income, education, and financial capability our initial modelling shows that women are still significantly less likely to have a private pension. However, the most influential factors in pension ownership are qualifications and financial capability.

The changes to employment caused by the pandemic have led to many people experiencing a fall in income that has left some looking to reduce expenditure, and for those who have had to cease work, pension contributions will have been effected.

FCA research shows that among those who were contributing to a pension in February, a larger proportion of men have also reduced pension contributions – 12% compared with 9% of women. However, more women have stopped contributions altogether – 7% compared with 5% of men.

This could be a concern as fewer women had a pension in accumulation at the start of the pandemic and efforts will need to be made to restart pension contributions when circumstances allow.

There have of course been some people, who maintained employment and salary while saving on other expenses such as travel, who have been able to increase their pension contributions. This group is much more likely to be men. Nearly one in five men have increased pension contributions during the pandemic compared with one in ten women.

Overall the difference in private pension saving that already existed between men and women appears likely to have widened as a result of the pandemic.

Assets and debts

There is no difference between men and women in terms of owning their home outright: 32% and 33%, respectively. However, there are some differences in the proportion who have a mortgage (36% for men compared to 33% for women), and renting (21% compared to 24%).

Excluding housing wealth, a higher proportion of men report larger amounts of investible assets at all ages.

Mean investible assets by age and gender

Source: Financial Lives survey 2020 Base: All UK consumers (16,190)

For both men and women the amount of investable assets increase with age, but the level increases at a faster rate for men compared with women. This could be due to a number of reasons – higher earnings can allow more money to be saved, and potentially differences in gaps in employment due to caring responsibilities.

Also a greater likelihood to receive financial advice and take risks by investing in higher risk products can lead to greater returns. At the same time excluding mortgage debts a higher proportion of men have debt at all ages compared to women. However, this decreases for both as they get older.

Mean debt by age and gender

Source: Financial Lives survey 2020 Base: All UK consumers (16,190)

The use of credit

When looking at all the different types of credit products owned before the pandemic began, a higher proportion of men have any type of credit product. This is being driven by a higher proportion of men having a credit card (72% compared to 64% of women), personal loans (17% compared to 14%) and motor finance (15% compared to 11%).

However, there are certain types of credit that women are more likely to own. These are mainly retail finance products such as store cards (18% of women compared with 10% or men), catalogue credit (18% compared with 7%), and high cost loans (13% compared with 8%).

When looking just at catalogue credit and controlling for other factors, women are nearly 3 times as likely as men to own this type of credit. Another important determining factor in ownership of catalogue credit is age, with 35-44 year olds more likely to use this product.

Since the start of the pandemic, more men than women have applied for and been turned down for credit. Nearly a quarter of men – 24% – applied for credit between March and October compared to 18% of women. Meanwhile, 11% of men have been declined credit compared to 8% of women.

How people reacted to being refused credit also showed significant differences between genders.

Actions taken following being turned down for credit

Source: Financial Lives Covid-19 Survey October 2020: UK consumers declined for credit since Feb 2020 (2,447)

As the chart above shows, among those who had been declined credit 44% of women went without, compared to 35% of men. A slightly higher proportion of women than men reported borrowing from friends or family.

A higher proportion of men used their savings or sought another form of credit. Around one in five men turned to another regulated lender compared to 13% of women. And notably a higher proportion of men than women (14% compared to 8%) borrowed from an unlicensed money lender.

How have men and women coped with changes to their financial situation?

Looking at how people’s financial situation has changed so far, 39% of women (10.3 million) report that they feel their financial situation has worsened between March and October compared to 37% of men (9.7 million) – a small but significant difference.

Looking at differences by age group shows that the highest proportion of those affected are women aged 18-24 (53%) and women aged 25-34 (48%). In the 65+ age group the differences are reversed with more men having seen their financial situation worsen compared to women.

Worsening financial situation by age and gender

Source: Financial Lives Top Up survey October 2020 Base: All UK consumers (22,260) Excluding Don’t Know

Controlling for other factors, there were no significant differences based on gender alone in terms of people feeling that their financial situation had worsened. Linked to these changes in financial situation, the Covid-19 pandemic has led to increased levels of anxiety and stress among many.

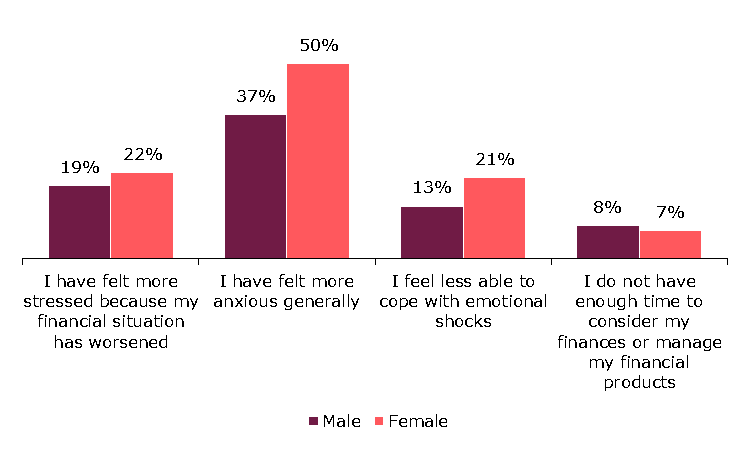

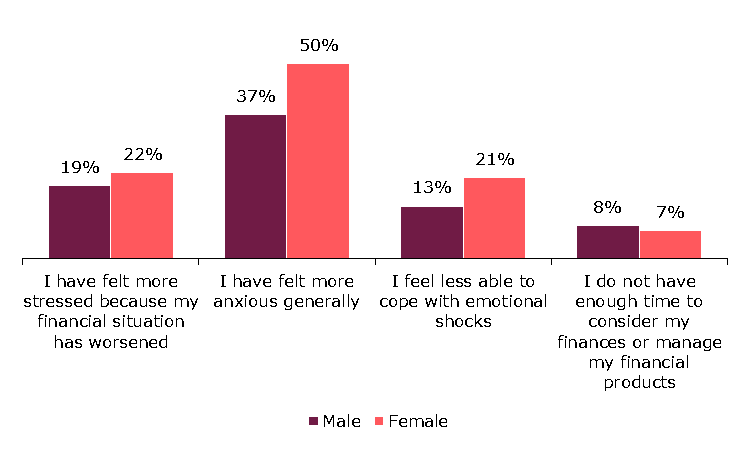

The FCA survey data shows that levels of stress due to negative changes in financial situation were higher among women compared to men – 22% compared with 19% – and were generally higher on all measures for women.

Anxiety by gender

Source: Financial Lives Covid-19 survey October 2020 Base: All UK consumers (22,267)

How people have coped

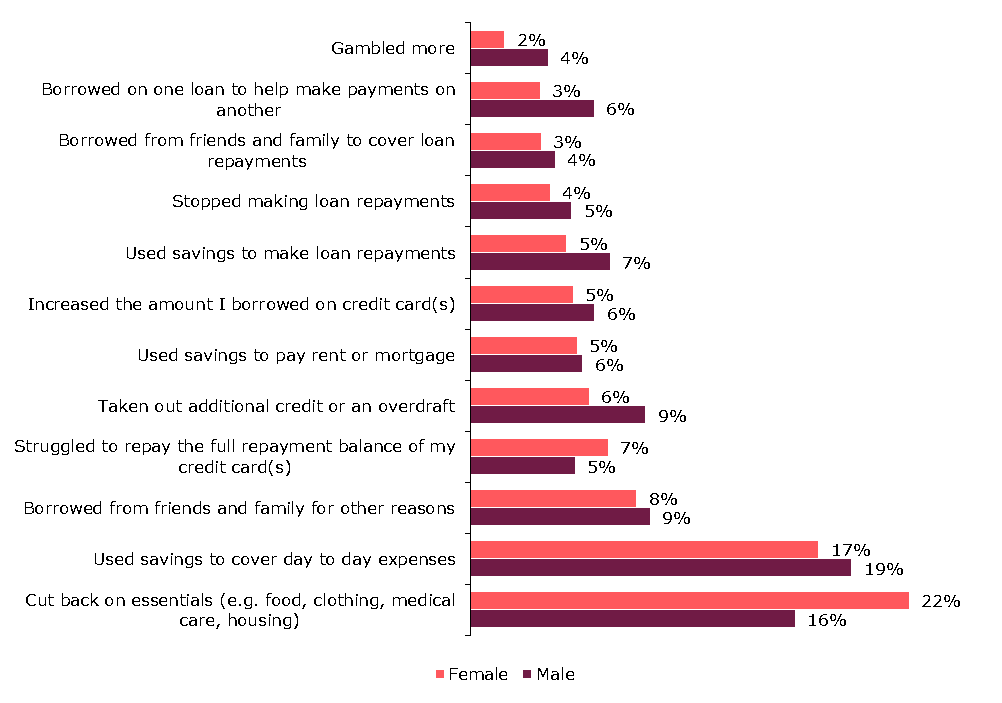

Changes to someone’s financial situation, or expected future changes, lead to a range of different coping strategies. The survey data we have suggests significant differences between how men and women have approached the financial challenges of the pandemic so far.

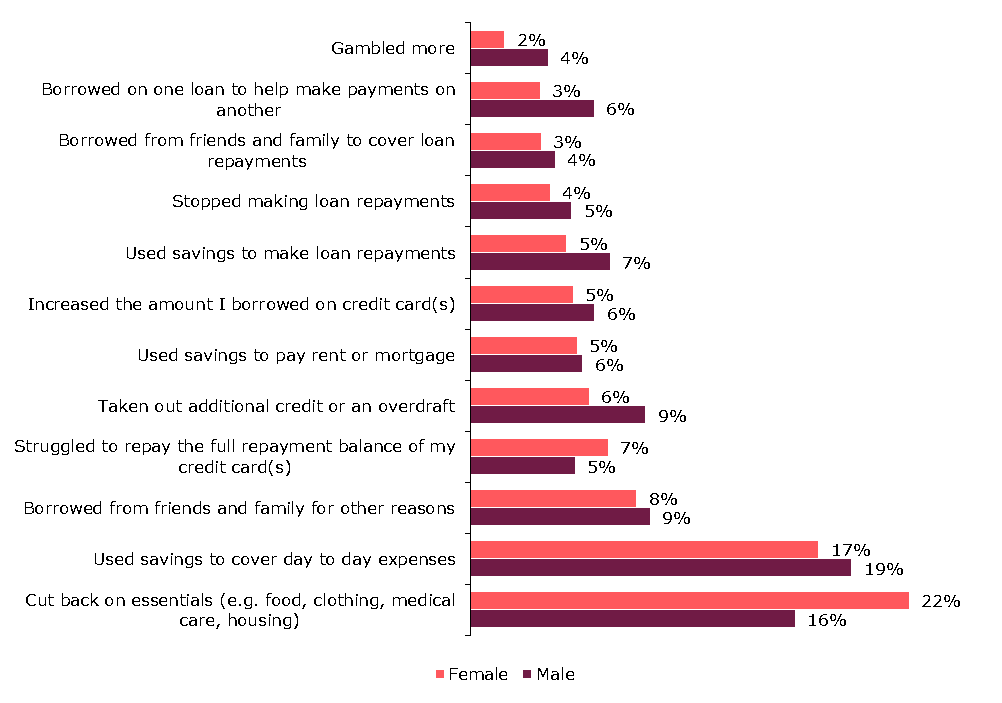

As shown in the chart below, a higher proportion of men have taken out additional credit – 9% (2.2m) compared with 6% (1.5m) for women. A higher proportion of men have borrowed on one loan to make payments on another – 6% (1.6m) compared with 3% (0.9m) for women.

Meanwhile 22% of women (5.7 million) have cut back on essentials compared with 16% of men (4.1 million). For both men and women, younger age groups are more likely to have experienced any of these signs of distress.

Signs of financial distress by gender

Source: Financial Lives Covid-19 survey October 2020 Base: All UK consumers (22,267)

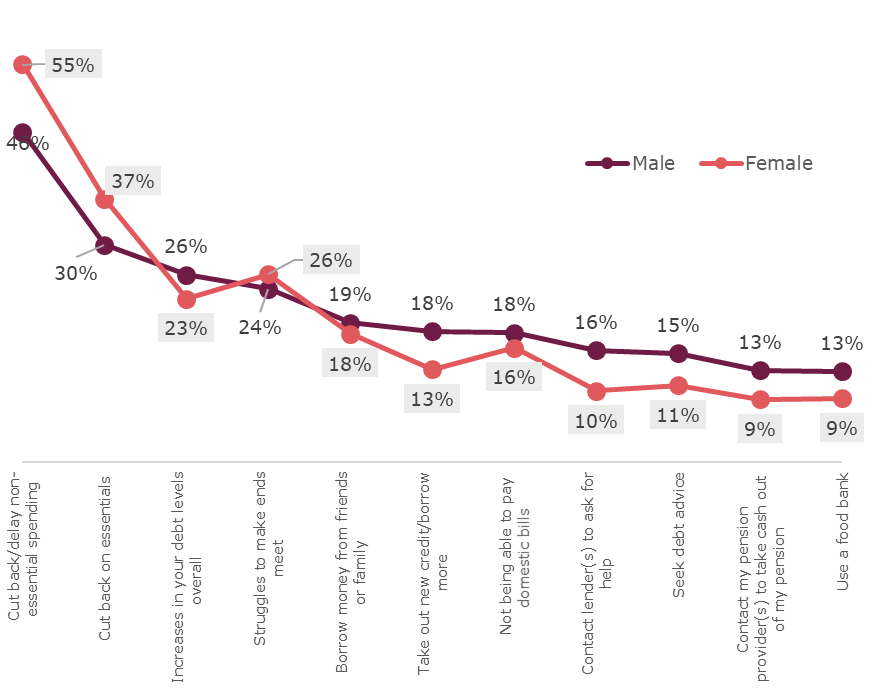

Looking ahead

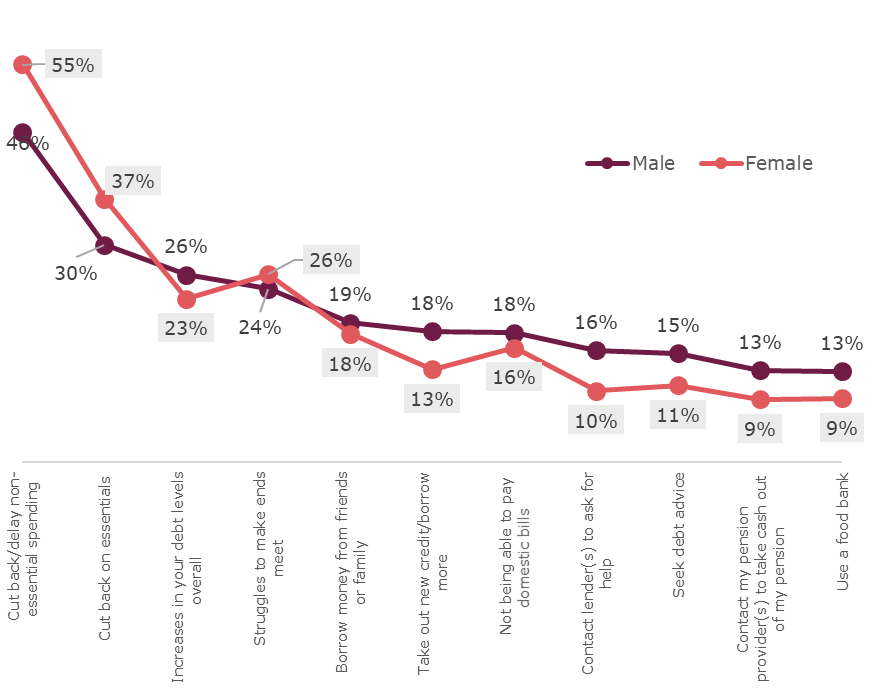

In October 2020 research investigated people’s outlook for their finances in the next 6 months. Survey answers suggested that the patterns already seen during the pandemic were expected to continue, with men more likely to use credit and women more likely to reduce spending.

More men than women expected to contact lenders for help or seek debt advice. Conversely over half of all women (14.6m) said they were likely to cut back on non-essential spending, and 37% (9.6m) said they would cut back on essentials.

Future expectations by gender

Conclusions

Looking at financial products owned before the pandemic, underlying differences in income and accumulated wealth are likely to be contributing factors to the differences in products owned between men and women. Confidence in interacting with products and services and attitude to risk can also have an impact.

Our analysis shows that a higher proportion of women rate themselves as less confident about financial services. However, unsurprisingly, when we control for other factors, gender itself is not important with regard to an individual’s financial capability.

While men have on average more investible assets than women they also make greater use of credit, and they are more likely to have investment products, perceived to be riskier than the cash savings more commonly held by women.

The pandemic has caused a drop in household income for around a third of all UK adults. Our analysis suggests that pre Covid-19 attitudes, such as attitude to risk, and familiarity with credit have fed into the differences in how men and women have responded to the changes in their financial situation.

Having been broadly equally impacted by changes to their financial situation men are more likely to have increased their borrowing while women are more likely to have cut back spending.

Further borrowing in the face of reductions of income is only ever likely to be a short-term strategy and our analysis shows that it is men more than women who expect to be seeking help in the months ahead.

As the economy reopens following a third national lockdown, it will be important to understand the different challenges facing men and women in their financial recovery from the Covid-19 pandemic.

For more insight into the impacts of the Covid-19 pandemic on people’s financial situation please see the FCA’s Financial Lives Survey.