This page provides a broad overview of the access to cash evidence base, including the impact of coronavirus (Covid-19), which will inform our ongoing work on access to cash.

Jointly with the Payment Systems Regulator (PSR), we have published an updated assessment of the UK’s cash infrastructure and wider banking services, alongside our commissioned consumer research exploring the needs and preferences of people that view themselves as reliant on cash.

Access to cash and banking services remain vital for many consumers and businesses

Download accessible version of the infographic (PDF)

Coverage of access to cash and banking services across the UK

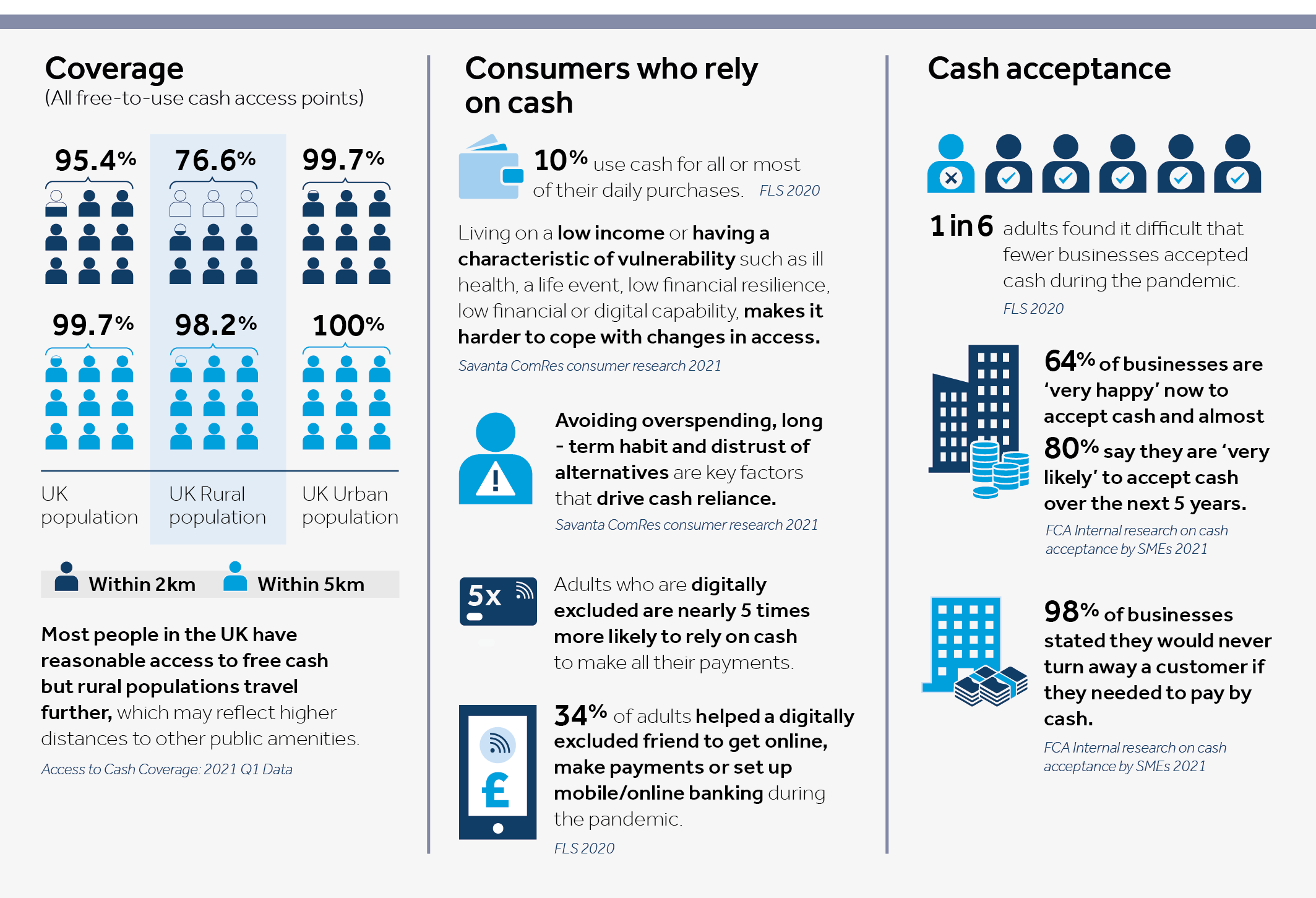

Based on our joint research with the PSR, Access to Cash Coverage: 2021 Q1 Data, most people have reasonable access to cash through a combination of bank, building society or Post Office branches and ATMs. We estimate that 95.4% of the UK population are within 2km of a free cash access point and 99.7% are within 5 km.

The rural population travel further to withdraw and deposit cash, which can reflect higher distances to all services such as shops, facilities and public services. 99.7% of people living in urban areas in the UK have access to a free source of cash within 2km. This falls to 76.6% of the UK rural population. When considering the 5km distance, 98.2% of the UK rural population are within a free source of cash. Overall, we estimate that 99% of the UK rural population have access to a free source of cash within 5.7km.

Wide reach of cash services is promoted through LINK’s financial inclusion policies and the Post Office geographic coverage, bank branches and cashback.

Consumers with characteristics of vulnerability who rely on cash

Despite a decline in use, cash remains important to some segments of the UK population including some of the most vulnerable. Building on our Financial Lives 2020 survey that found that 10% of adults say they rely on cash for all or most of their daily purchases, we commissioned qualitative research to understand those consumers’ need for cash, how they access it, and to gather insight into their demographic and vulnerability characteristics. Read Savanta ComRes Understanding cash reliance – qualitative research.

There is a broad spectrum of consumers who say they rely on cash. Research by Savanta ComRes shows that there can be an increased risk of harm from changes in cash access where consumers depend on cash often due to very low incomes and/or display characteristics of vulnerability such as ill health, life events, low financial resilience, and lower financial or digital capability. Our Financial Lives 2020 survey found that adults who are digitally excluded are nearly 5 times more likely than the UK average to rely on cash to make all their payments. Citizens Advice research shows that individuals on low household incomes and those with a physical health condition use Post Office banking most frequently, while those are digitally excluded, aged over 65 or on low incomes are more dependent on bank branches.

Coronavirus has accelerated the uptake of digital payments but not everybody has been able to cope with changes in banking and payments. Our Financial Lives 2020 survey found that, during the pandemic, 1 in 3 adults (34%) have helped a digitally excluded friend, neighbour or relative to use the internet (21%), make payments online (18%), or set up online or mobile banking (11%). A critical part of maintaining access to cash and banking services for those that still need it is to support those who can transition to digital and other alternative ways of banking and making payments.

Trends in cash acceptance

More individuals are encountering cashless stores than they were pre-pandemic. Our Financial Lives data shows that, although 73% of respondents coped with fewer businesses accepting cash, 1 in 6 adults have found it difficult.

Our internal research on cash acceptance by small and medium-sized enterprises (SMEs) found that the primary motivation for accepting cash is to provide customers with choice. Despite the sharp drop in cash usage, nearly two thirds are ‘very happy’ now to accept cash and almost eight in ten say they are ‘very likely’ to accept cash over the next 5 years.

Industry developments and innovation

During the pandemic, the banking and finance industry put additional measures in place for people in vulnerable circumstances and those who were shielding. These measures included home cash deliveries, carer cards and digital training. The contactless card limit was also increased to £45 in March 2020. Looking forwards, innovative methods such as banking hubs and cashback without a purchase are being trialled through the Community Access to Cash Pilots.

An Access to Cash Action Group has been set up by 8 banks and building societies chaired by Natalie Ceeney, Chair of the Community Access to Cash Pilots Board and David Postings, CEO of UK Finance. The Group will ensure cash will be available for those who need it, particularly small businesses, the elderly and vulnerable. This will build on work by LINK to build financial inclusion goals into the way ATMs are provided and by the Post Office to provide broad coverage in cash withdrawal and deposit services.