Assets under management in ETFs have jumped from just over $400m in 2005 to over $5 trillion today.

Small wonder that regulators around the globe are looking closely at passive investments, and ETFs in particular, and asking whether this rapid growth could become a source of future market instability.

In some parts of the ETF market, trading is concentrated in a very small number of firms and when the underlying assets are already known to be illiquid, the potential for market instability seems obvious.

We are in the early stages of research into the ETF market and much work remains to be done. However, initial findings based on analysis of some ETF market hotspots offers some reassurance.

ETFs - a hybrid beast

First, we need to understand the distinct features of ETFs.

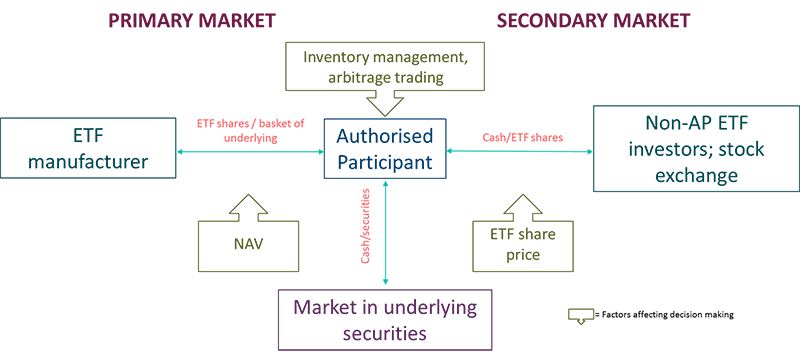

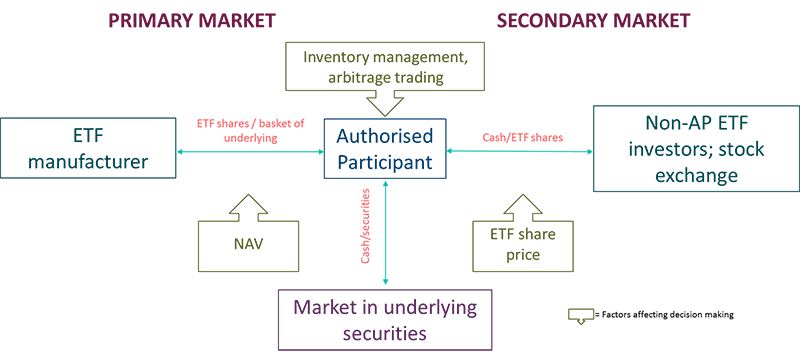

To retail and most other investors, ETFs appears straightforward - they can buy or sell shares in an ETF in the secondary market. But this is not like trading in units in an open-ended fund, where a sell leads to a redemption and a buy means new investment money entering the fund. Trade in the secondary market does not directly alter the total amount of funds in the ETF.

The creation and redemption of ETF units takes place in the primary market. This primary market is open only to Authorised Participants (APs), which are typically, but not exclusively, principal trading firms and large global investment banks. As the only players in the primary market, the APs are the only entities that can create or redeem units in transaction with the ETF manufacturer.

The APs also trade in the secondary market, buying and selling ETFs with other investors, and also in the wider markets for the underlying assets.

The ETF ecosystem

All this means the APs are in a unique and pivotal position, actively trading in all directions and across the whole ecosystem, from underlying assets to the creation and redemption of ETF units.

This interrelated activity by APs is crucial – it is the process that keeps the ETF price moving in alignment with that of the underlying assets.

If APs were to stop or significantly reduce their activity, it could lead to ETF unit prices diverging significantly from the price of underlying assets in either direction and hence a disorderly market.

Primary market concentration

We have started researching these questions using unique data from a regulatory request to ETF manufacturers. This dataset covers daily creation and redemption of units in 257 ETFs, with assets under management of $381 billion and representing about 7% of the global ETF market.

The data show the primary market in ETFs is highly concentrated. The 5 largest APs account for about 75% of primary market trading volumes.

This concentration is even greater in fixed income ETFs where the top 5 APs account for 91% of trading volume and more than half (51%) was handled by a single AP.

Given these concentrations and the relative lack of liquidity in fixed income assets themselves, this was a natural point of our focus for examining potential liquidity problems in times of market stress.

Our research looks at three moments of market stress: a sharp sell-off in fixed income securities in December 2018; a spike in market volatility in February 2018; and the US Presidential election in November 2016.

All three events showed similar patterns, but the Presidential election was marked by the net outflow of funds from ETFs – primary market redemptions exceeded unit creation. This was the only incidence of net redemptions in the sample and so is the most useful for assessing stress on the ETF primary market.

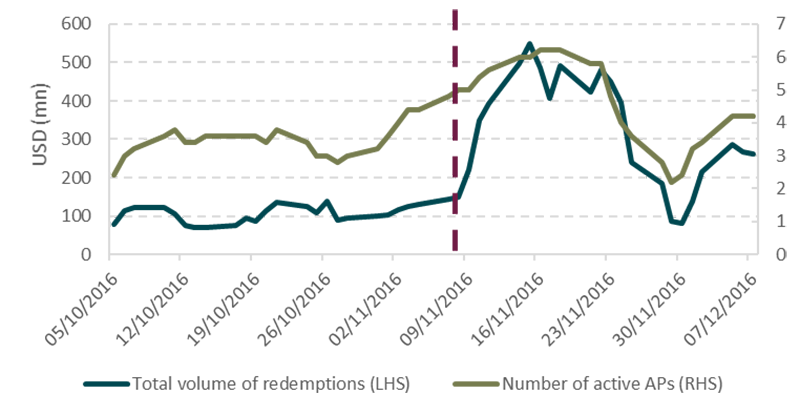

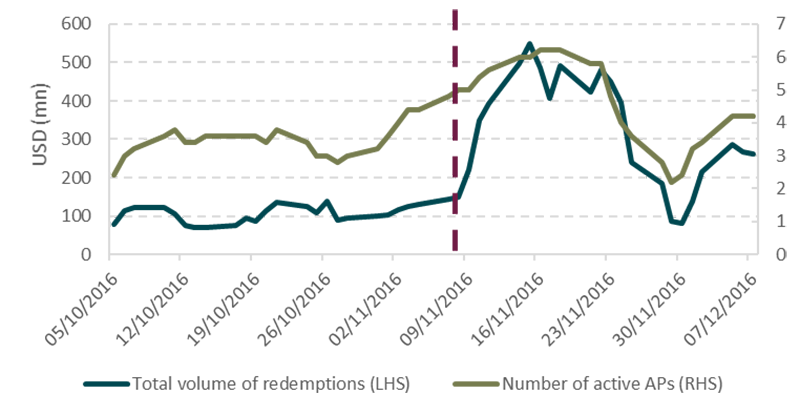

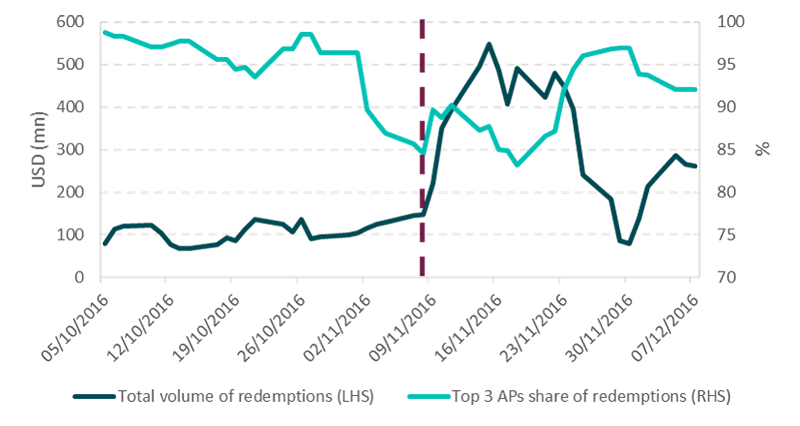

Our work so far has looked at two key indicators: the number of APs active in the market around the event; and the market share of the three most active APs.

Two clear points emerge.

Volume of redemptions and number of active APs

As we can see, redemptions of fixed income ETFs soar and as they do so, the number of active APs also rises. So during this period of stress, APs who are normally less active, entered the market, providing liquidity.

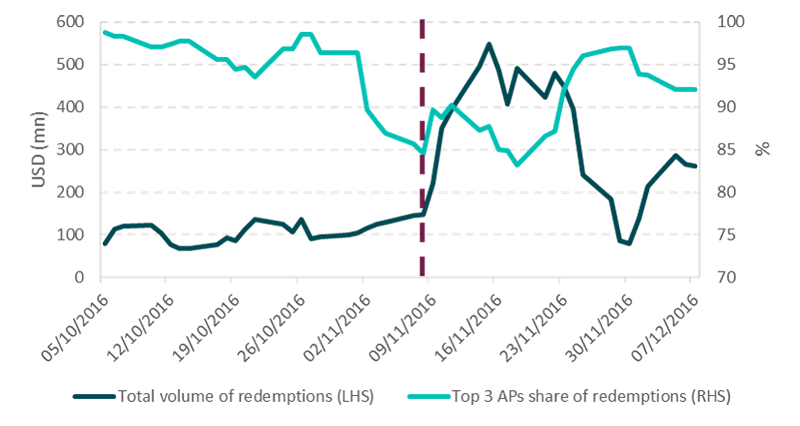

The second point concerns the concentration in the market.

Volume of redemptions and market share of top 3 APs

Here we see that the share of redemption volumes of the top 3 most active APs drops, and only recovers when the volume of redemptions starts to fall.

In other words, when the market faced a period of stress, other APs entered the fray, not only taking up the extra redemptions, but actually taking a higher than typical proportion of redemption volumes.

So while in typical trading periods the primary market is highly concentrated, in times of stress other APs step in to provide alternative liquidity.

This initial research has produced a balance of findings. On the one hand, it reveals a significant concentration of activity among a tiny number of participants in the ETF primary market.

On the other, it shows preliminary evidence for alternative liquidity providers being willing to step in during times of market stress. Beyond these reassuring results, the analysis does not detect any initial signs of concern to financial stability.

But, this analysis is only the first step in investigating the resilience of ETF markets. The FCA’s unique datasets provide us with further opportunities to research the links between ETFs and stability in more depth.

Future work will examine not only primary markets further, but also secondary markets and the markets in the underlying assets of ETFs. This will allow us to address more complex questions, such as how ETF the primary and secondary markets for ETFs interact with the market in the underlying securities.

Find out more in the detailed analysis