The Covid crisis has had particular effects on different communities and, as examined in the previous Insight article, this can be seen in a higher proportion of BAME consumers leaving employment and sharper falls in average wages compared to the population as a whole.

But what does that mean for the financial decisions and behaviour of people in different communities?

Our analysis set out to understand how BAME consumers used financial products before Coronavirus, and what the impact of Coronavirus has been, so far, on their financial situation. We also explored whether ethnicity alone has an impact on a person’s ability to access and engage with the financial services market. We recognise that all consumers are unique and there will be differences between the diverse ethnic groups in the UK. So while we mainly focus on BAME consumers, where sample sizes permit we look at outcomes for more specific ethnic groups.

The starting point for our analysis is data from the FCA’s Financial Lives 2020 survey which allowed us to look at the differences that existed between BAME and White consumers in terms of products owned, assets and debts and financial confidence before Coronavirus. This was combined with further FCA research conducted in October 2020 (our Covid-19 panel survey) to look at some of the impacts the pandemic has had, so far, on different groups and how this has influenced financial decisions and behaviours.

There are several underlying differences in the ethnic groups that make up the UK population. Before we begin our analysis, it is important to understand these differences as these impact a person’s finances and the ways they interact with the financial services markets.

The gender balance is similar across ethnic groups in the UK, but the same cannot be said for age profile. The BAME UK population is younger - 46% of BAME consumers are aged under 35, in comparison to 27% of White consumers.

As outlined in an earlier Insight article overall employment levels were similar pre-Covid. Earnings of BAME workers had dropped by an average of 14% (vs. their February level), whereas White workers’ earnings had dropped on average by 5%. Naturally, differences in employment determine earnings which in turn influence engagement with the financial services markets.

Reflecting these differences, we estimate pre pandemic differences between BAME and White consumers in terms of their use of financial services and products using logistic regression to control for differences in factors such as age, gender, and household income. Keeping the same controls, we then study whether and how the pandemic has impacted this picture, i.e. has the crisis altered the differences between ethnic groups in use of financial services and products. This article presents results of our initial modelling and, as we only look at social demographic factors, this modelling only explains some of the difference between BAME and White consumers. Non-socio-demographic factors such as attitudes and experiences are important, but are not captured in depth here. However, this approach allows us to understand whether ethnicity itself is a factor when considering the differences between the two groups and, crucially, whether ethnicity alone has led to different financial experiences during the pandemic.

Ownership of financial products

Before Coronavirus there were differences in the proportions of types of financial product held by BAME and White consumers, as set out below.

Significant differences in product ownership before Coronavirus before Coronavirus (Feb 2020)

Source: Financial Lives 2020 survey - Base: All UK consumers (16,190) Investments excludes investment property or other real investments and exchange tokens/ cryptocurrencies.

From this overview, we now look at 4 areas:

- Banking

- Savings, investments and pensions

- Financial assets and housing

- Credit and debt

In each case we can examine the differences that existed before Coronavirus between ethnicities across these areas and whether the advent of Coronavirus led to different journeys for different groups.

Banking

Ownership of a bank account is for many a gateway and a first step into financial services. For most it is an essential product that enables payments from employment, saving for the future and – in particular during Coronavirus when cash is less readily available and accepted – a means of paying for goods and services. Our research shows 1 in 10 of all adults have struggled to cope during lockdown with fewer bank branches open and fewer businesses accepting cash.

While most UK consumers do have a current account from a bank or building society, a small minority do not and are classed as ‘unbanked’. This proportion in February 2020 is significantly higher among BAME consumers than White consumers – 4% compared with 2%. Within the different BAME groups, the highest proportions unbanked are Asian consumers (6%) and Mixed-race consumers (5%). Our initial modelling suggests that controlling for gender, age, income, education working status, and financial capability, there is no significant relationship between ethnicity and being unbanked. So, while overall levels of unbanked are higher among BAME consumers our initial modelling shows the strongest predictors – those that are both significant and have larger odds ratios – to be low income, and being aged 25-34, meaning those who are young or on low incomes are more likely to be unbanked, regardless of the ethnic group to which they belong. Because as a group, BAME consumers tend to be younger and have lower incomes they are over represented in the unbanked group.

Savings, investments and pensions

Having savings and being able to put money away for a rainy day is essential for future planning and to withstand financial shocks. The pandemic has shown how important having a savings buffer is. Among those with savings, 34% of consumers say their level of savings has dropped during the pandemic, as people have had to use savings to cover essential day-to-day and housing costs.

Fewer BAME consumers had any savings products (67% compared with 79% for White consumers) in February 2020. Looking at different age groups, as is shown in the figure below, this is true for all age groups. Our initial modelling suggests that, controlling for gender, age, income, education, working status and financial capability, BAME consumers are more likely than White consumers to have any savings account. The strongest predictor of having any savings account in our modeling was being retired or semi-retired, regardless of ethnicity.

Savings, investments and pensions by ethnicity and age (Feb 2020)

Source: Financial Lives 2020 survey Base: All UK consumers (16,190) Investments excludes investment property or other real investments and exchange tokens/ cryptocurrencies.

BAME consumers more likely to have eaten into their reserves

However, the way these savings have been used during Coronavirus does differ significantly between groups. Since the pandemic began, a higher proportion of BAME consumers have used their savings to cover expenses. Among BAME consumers 11% have used their savings to cover loan repayments, compared to 5% of White consumers.

A similar pattern is seen for other expenditure, with 26% of BAME consumers using savings for day-to-day expenses compared with 17% of White consumers, and 10% using savings to cover housing costs compared with 5% of White consumers.

There are similar differences for investment product ownership - 27% of BAME consumers own an investment product (excluding property, other real investments like jewellery, and cryptocurrencies) compared with 35% of White consumers. However, a higher proportion of younger BAME consumers have any investments than White consumers of the same age - 23% compared with 17%.

But again, since the Coronavirus pandemic began, there have been significant differences in how the two groups have used those investments. A higher proportion of BAME consumers (15%) who had any type of investment product have moved money into cash because of concerns about market volatility compared with 10% of White consumers.

BAME consumers have also been more likely to cash in some of their investments to support their income - 23% of those who had investments cashed them in compared with 14% among the White population.

Of course, there have been consumers in all groups who have added to their investments during Covid, but here too we identified a difference. A higher proportion of BAME consumers have invested in a high-risk product (9%) compared with 5% of White consumers.

A higher proportion of BAME consumers who are approaching retirement do not have any protected means of retirement savings, with 37% of BAME consumers (and as high as 45% for Black & Black British) saying the State pension will be their main source of income in retirement, compared with 31% of White consumers.

When it comes to pensions we again see a similar pattern. Over three-quarters (77%) of White consumers have private pension provision (in accumulation or decumulation) compared with 57% of BAME consumers. This varies significantly among the different BAME groups – being highest for Black and Black British consumers (64%) and lowest for Arab consumers (45%). However, when we control for gender, age, income, education and financial capability, our initial modelling shows that there is no significant relationship between ethnicity and having any private pension. The most influential factors in pension ownership are qualifications and financial capability.

In summary, the differences in use or ownership of various savings and investment products between ethnic groups largely reflects the different underlying profile of each group – notably age. But during Covid BAME consumers have been more likely to use their savings or to reduce payments into pensions to top up their income or meet other expenses.

This of course may have longer-term consequences for pensions and also for the accumulation of other financial assets – typically for use in later life.

Financial assets and housing

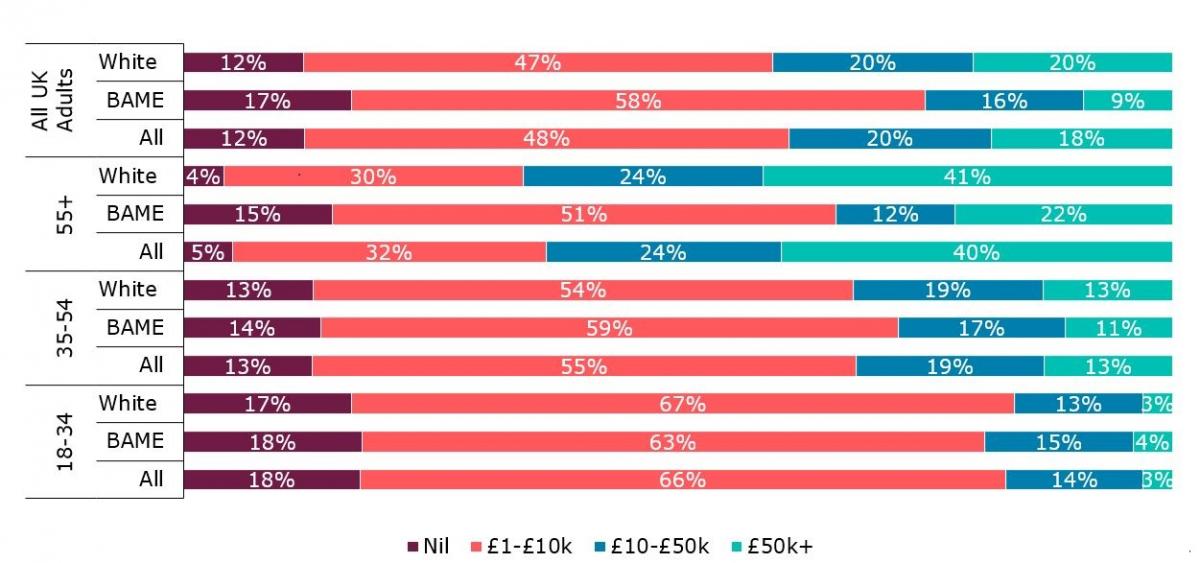

Overall, BAME consumers have less in investible assets compared with White consumers. 17% of BAME consumers have no investible assets compared with 12% of White consumers; and a quarter of BAME consumers have investible assets of over £10k compared with 40% for White consumers.

As we have seen before this is mainly a generational effect. Among most age groups the difference in assets held between BAME and White groups is not significant. But in the 55+ age group the difference is marked. Only 34% of BAME consumers aged 55+ have investible assets of over £10k, compared with 65% of White consumers in the same age group.

Age, ethnicity, and investible assets (Feb 2020)

Source: Financial Lives 2020 survey Base: All UK consumers excluding ‘don’t know’ and ‘prefer not to say’ (12,753) Note: total investible assets excludes housing and pensions

There is also a further dimension to this. As well as BAME consumers over 55 having fewer investible assets than White consumers in the same age group, they also depend on these assets in a different way. The Financial Lives 2020 survey found that from age 75+ the investible assets held by BAME consumers start to fall while those of White consumers continue to rise.

This suggests that BAME retirees are more dependent on these assets, rather than pensions, to fund their retirement.

Average investible asset amounts in February 2020

Source: Financial Lives 2020 survey Base: All UK consumers (16,190) (excludes housing and pensions)

The principle asset that most consumers may acquire is of course a house and there are stark differences between groups in terms of ownership and renting.

A third (33%) of BAME consumers were renting in February 2020 compared with one in five (21%) of White consumers. Since February 26% of BAME renters have asked, or are considering asking, their landlord for a rental payment holiday. The equivalent figure is just 12% for White renters.

And in terms of home ownership, 15% of BAME consumers own their house outright, compared with 35% of White consumers.

The overall picture of savings, investments and assets between BAME and White groups and the effect of Coronavirus raises some concerns.

The historic data shows that when looked at as a group, the older generation of BAME consumers have accumulated fewer assets over their lifetime than White consumers – and are probably more dependent on those assets for income during retirement. It also shows that younger BAME generations have been closing this gap, saving and investing at rates similar or close to their White peers.

But Coronavirus has brought changes that put this at risk. During the pandemic BAME consumers have been more likely to be dependent on their savings to top up income and more are opting to cash in investments or reduce their pension contributions to help them get by.

This risks reversing or slowing the trend towards parity in savings and retirement planning, and the gap may once again begin to widen.

Credit and debt

For many adults credit is essential. So far throughout the pandemic around 10% of consumers have taken out additional credit or an overdraft, or increased the amount borrowed on credit cards. Over the same period, around 15% of those with a credit card have struggled to repay their full balance.

In February, the majority (63%) of all consumers had zero debts (excluding mortgage and student loan debt). This was 62% for White consumers and 68% for BAME consumers. The differences are more marked when specific ethnic groups are considered. Asian consumers are the most likely to be debt-free (73%). The equivalent figures for Mixed race consumers was 63% and for Black and Black British 60%.

Distribution of amount owed on credit by age and ethnicity in February 2020

Source: Financial Lives 2020 survey Base: All UK consumers (Rebased to exclude PNTS 15,748) (excludes mortgage and student loan debt)

Average credit debt amounts by age groups are shown above – excluding mortgage and student loan debt. As can be seen mean average amounts are lower for all BAME age groups except for those aged 55-64.

Our survey carried out in October has shown that during the first 7 months of the Coronavirus crisis there were clear differences in the way different groups have used credit. This is seen most distinctly in the use of credit deferrals with 43% of BAME credit holders deferring credit payments compared to just 16% among White credit users. There were also differences for the use of the mortgage payment deferrals – 23% for BAME mortgage holders compared to 17% for White mortgage holders.

Before Coronavirus, a higher proportion of BAME consumers were over-indebted – 22% compared with 13% of White consumers. BAME consumers were also more likely to class domestic bills or credit commitments as a heavy burden – 17% compared with White consumers – 9%.

Looking at the situation in October a larger number of all consumers are classed as over-indebted and the gap has widened between White and BAME consumers. In October 15% of White consumers were over-indebted compared with a quarter (26%) of BAME consumers. However, when we control for gender, age, and income, our initial modelling shows that there is no significant relationship between ethnicity and being over-indebted. The most influential factor was age.

Similarly, we looked at whether an individual has fallen behind on, or missed, any payments for credit commitments or domestic bills for any one month or more of the last 6 months, up to October 2020. Again, the figures are larger for BAME consumers with 32% falling behind or missing a payment compared with 15% of White consumers.

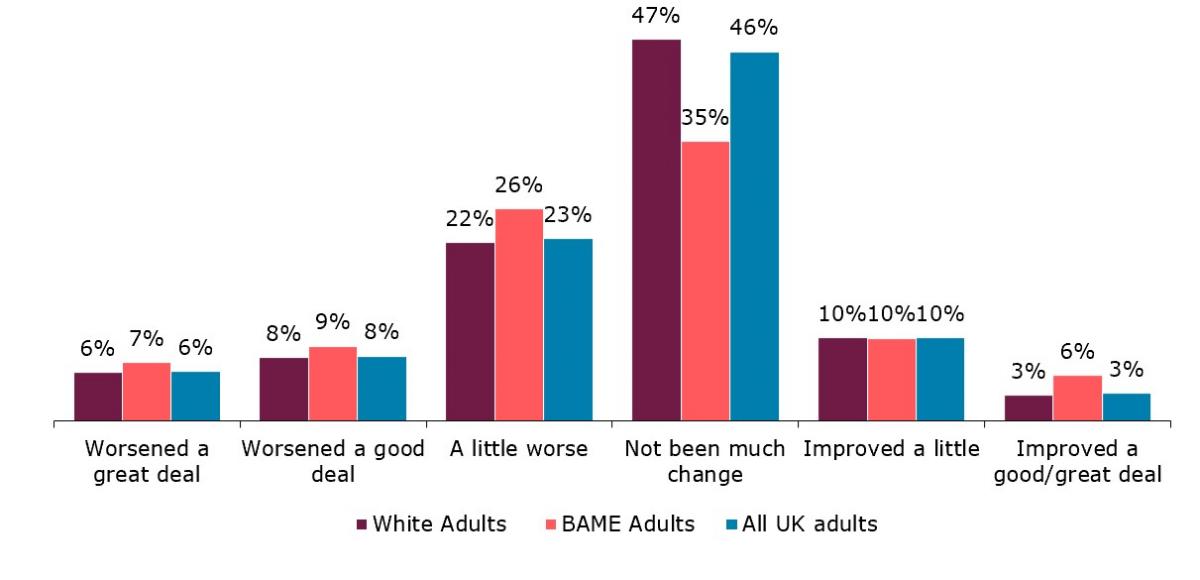

A higher proportion of BAME consumers report that their financial situation has worsened in any way in the period since the epidemic began – 42% compared with 36%. However, a higher proportion of BAME consumers are also reporting their financial situation has improved – 6% compared with 3% of White consumers.

Impacts of Coronavirus on financial situation

Source: Financial Lives Covid-19 survey October 2020 Base: All UK consumers (22,267

Controlling for other factors, there were no significant differences based on ethnicity alone in terms of people feeling that their financial situation had worsened, meaning differences in how consumers report changes in their financial situation is driven by other factors such as changes to employment.

Conclusions

Our analysis shows that prior to Coronavirus, comparing BAME consumers to White consumers there are significant differences. These differences are in the type of products consumers of the different ethnic groups own, their levels of savings and debt, and satisfaction with their financial situation. We then see that since the pandemic began a larger number of BAME consumers than White consumers feel their financial situation has worsened.

However, when we control for factors such as age, gender and income, ethnicity itself is not an important factor in financial product ownership, financial situation and use of financial services. While differences do exist in how different groups of people use different products (or do not use them) these differences are largely explained by factors such as income and age. Our analysis, as well as research by other bodies, show us that BAME consumers are over represented in age and income groups where use of financial products tends to be lower.

When looking at the evolving impacts of Coronavirus on people’s financial situation, BAME consumers have seen a higher fall on average in earnings since February . Looking at the use and behaviour around specific financial products we see BAME consumers have been more likely to use credit or rent deferral, to cash in savings and reduce pension contributions – which may be significant in terms of longer term financial security.

These patterns have been seen across different ethnic groups, but they are more pronounced among the different groups of consumers that make up the BAME community. This suggests the differences between BAME and White consumers in their financial experience in 2020 may leave lasting effects.

Our next Insight will examine the financial effects of Covid-19 from the perspective of health. Subscribe below to receive an alert as soon as it is published.