Consumer investments in speculative mini-bonds are at risk should the issuer fail. In short, the investor might lose everything.

This is a not uncommon occurrence and the amount of money that consumers stand to lose is high. In January 2019, when London Capital and Finance (LCF), an issuer of speculative mini-bonds, was placed into administration, 11,625 people lost an estimated £237.2 million (FCA, 2019).

The Financial Conduct Authority has just published its Consultation Paper on a new risk warning for mini-bonds. The proposals are supported by behind the scenes work by behavioural scientists at the FCA and Warwick Business School. The aim was to discover how consumers are motivated to choose these products when the risk of losing everything is so high, and crucially what policy solutions can be demonstrated to work.

At the core of the work was a design-led approach – using behavioural science techniques to tackle the problem from the human angle.

Design-led thinking – a Double Diamond approach

Design-led thinking has also been used widely in the private sector. As just one example, Uber Eats (the food ordering and delivery platform) uses Design-led thinking to help improve their product. This includes Uber Eats designers visiting the cities where their product operates to understand local contexts and ‘Order Shadowing’ that allows designers to observe first-hand how their service operates at every stage and for all participants. (Medium, 2017).

This type of approach has also been used successfully for several policy interventions. Some examples include efforts to improve cyclists safety in the Netherlands (Van Essen, 2016) and interventions to reduce violence and aggression towards frontline hospital staff (British Design Council, 2011).

In the latter example, The British Design Council (2011) conducted extensive ethnographic research at three NHS trusts to explore and ultimately to reduce violence and aggression towards frontline hospital staff in A&E departments in the UK. The solutions, including clearer information for patients and guidance and training for NHS staff, resulted in a 50% reduction in threatening body language and aggressive behaviour and 75% of patients reporting that the improved signage reduced their frustration during waiting times.

There are several models of Design-led thinking, the one that inspired our approach was the British Design Council’s ‘Double Diamond approach, which consists of four well defined phases.

- Discover (exploration and analysis of user needs - using internal FCA investigatory data and initial policy identification of consumer harm)

- Define (articulating the challenge from the user perspective – liaising with internal FCA market specialists who have in-depth knowledge of retail investors)

- Develop (co-designing and testing potential remedies using online laboratory experiments to provide measurable evidence to support qualitative insights)

- Deliver (combining experimental evidence with investigatory data to create a holistic understanding of consumer behaviour to inform regulatory policy)

Under the Discover and Define stages of our design-led framework, we used behavioural and collaborative tools, such as brainwriting and red-teaming, to gather extensive internal FCA evidence on retail investors. This included input from internal FCA policy and supervisory specialists and to actual case files from FCA firm investigations including direct accounts from consumers.

“This is the thing about the financial world, isn’t it, I am not a financial person, it is not my area” – quote from a mini-bond investor.

This allowed us to build a picture of typical investors and below are some example consumer personas, similar to those designed in workshop sessions held under Discover and Define.

Discovering how different consumers interact with a mini-bond product was equally important for thinking about the testable effect of policy intervention. Our qualitative research cross-referenced the consumer journey – the initial awareness of need, to awareness of the product, and then to selection and finally purchase - with the consumer experience for typical consumer personas.

The research addressed the key touchpoints for the consumer - what do they do, think and feel at each step in the journey?

In this way the Discover and Define stages, provided an understanding of consumer motivations for investing in high risk products and what product features may influence these choices.

These could be summarised in three key qualitative insights:

- Consumers are generally unaware of the investment risk associated with these products

- Attractive marketing emphasises the potential rewards of these products without highlighting or even downplaying the associated investment risk is widespread

- The process for investing is quick and does not allow the consumer any time for reflection

These insights suggest that a key driver of consumer harm in this market is consumer misunderstanding and/or limited assessment of the investment risk associated with high risk products like mini-bonds.

So, under the next stage of our framework, Develop, we proposed a question - ‘would promotions that draw attention to and clearly explain this risk change consumer preferences for these products?’

Develop – testing qualitative insights in the online laboratory

As part of Develop, we wanted to test consumer preferences to obtain measurable evidence and a full picture of consumer decision-making for this type of high-risk investment.

To test our qualitative insights, we ran online laboratory experiments with Warwick Business School with 1,901 participants. The first experiment tested how consumers choose between investment products and their perception of investment risk across different products. Do consumers really prefer risky products and how might this change with the rate of return offered?

Experiment 1 Defining the problem

We designed our experimental set up to test pre-existing or common beliefs that arose during Discover about how certain features of financial promotions may influence consumers’ decision to invest.

Drawing on marketing features from real life example promotions, we created simulated financial promotions and asked participants to choose between them. We designed example adverts for a range of investment product types with different levels of investment risk – Cash ISA, Stocks and Shares ISA, Innovative Finance ISA, cryptoassets and speculative mini-bonds.

A higher rate of return makes a product more attractive, up until the advertised return is very high and then consumers become measurably more wary. So reassuringly, we found that consumers are aware of offers that are ‘too good to be true’.

But the findings highlighted the mini-bond anomaly. Our experiment found that on average consumers prefer the safer investment choice, but only on average.

While consumers were more likely to choose a product associated with a lower risk of losing all money invested, their choices for mini-bonds stood out. Despite their higher investment risk, consumers were still more likely to choose speculative mini-bonds than safer Stocks and Shares ISAs.

This may reflect a genuine consumer preference for a particular product. But given that in all other cases consumers revealed a preference for safer investment choices, this finding indicates that consumers could be underestimating the risks associated with speculative mini-bonds.

Experiment 2 Testing policy solutions

Previous FCA Insight articles have discussed the efficacy of risk warnings, largely to say that risk warnings should not be assumed to work in advance of testing.

Following concern about significant mini-bond losses, a new but temporary FCA risk warning was swiftly mandated for all promotions of speculative mini-bonds. A key aim of the research was to test whether the relative improvement of the warning and therefore assist in the policy decision of whether it should be made permanent in some form.

The traditional risk warning and common industry interpretation of FCA guidelines has been the familiar phrase ‘capital at risk’.

The new risk temporary risk warning introduced on mini-bonds on January 1 2020 was more explicit.

‘You could lose all of your money invested in this product. This is a high-risk investment and is much riskier than a savings account.’

Considering our qualitative insights from Define and Discover, that both a lack of awareness of investment risk and the visual downplaying of associated risks on financial promotions may lead consumers to make risky investment choices, we designed our second online experiment to test the relative effect of this new risk warning.

We compared consumer choices between financial promotions using the old risk warning those using the new wording. - examples of two fictional promotions with the new risk warning that was tested are shown below.

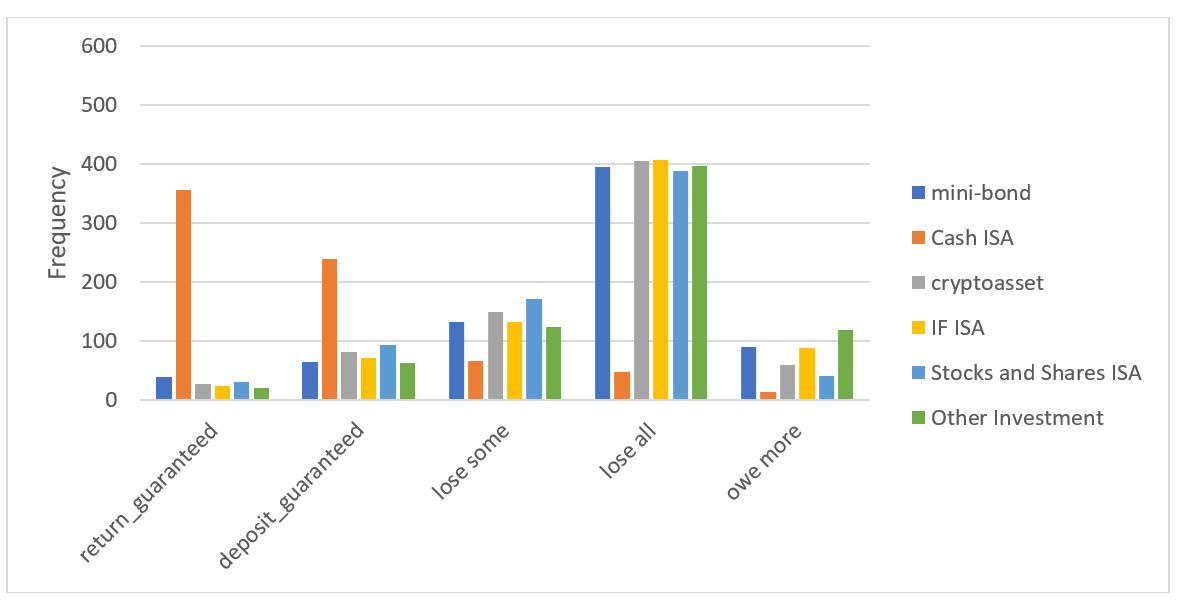

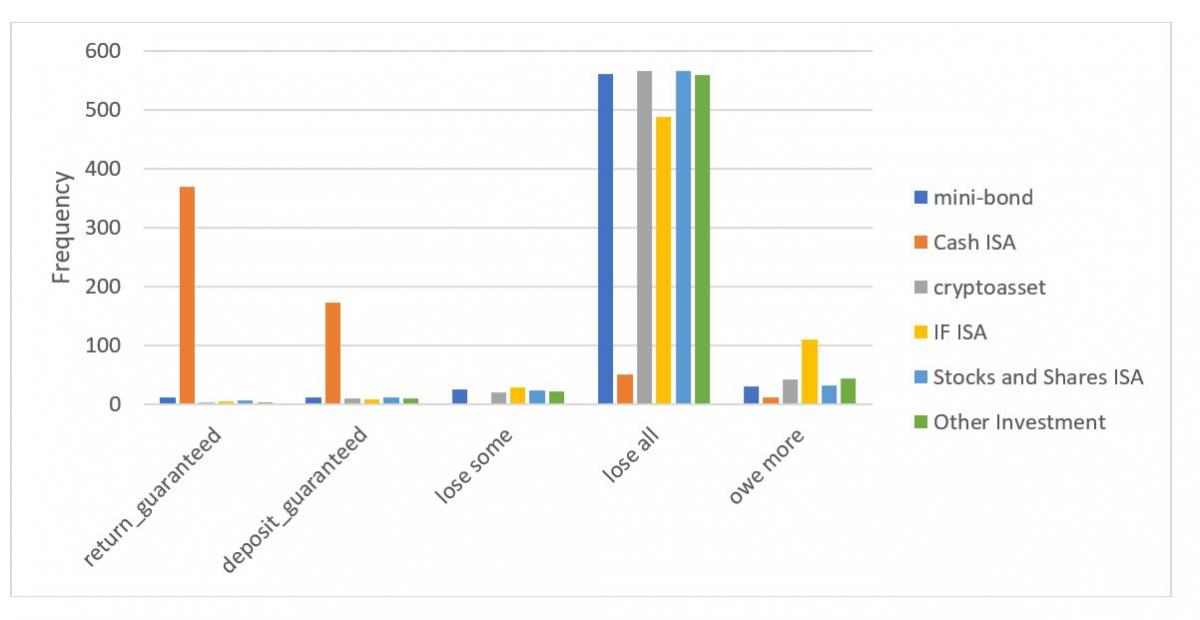

The findings were clear - the charts below show how participants rated the likelihood of different investment outcomes for different investment products when each of the two different risk warning are applied.

Consumer comprehension of the investment risk associated with mini-bonds is better when the new risk warning is applied. Consumers are measurably more likely to associate a mini-bond with the risk of losing all or some of the money they invest when they see a promotion with the new risk warning.

Traditional warning – ‘capital at risk

’

New risk warning - ‘You could lose all of your money’…

The experiments that we ran under Develop provide robust evidence about how participants, representative of the range of typical consumers who invest in mini-bonds, choose and respond to different presentation of financial promotions.

This measurable evidence of consumer behaviour and direct evidence for the effectiveness of FCA policy intervention, when combined with the insightful qualitative detail from Discover and Define, means that we have a full picture of consumer preferences to use to inform regulatory policy.

Deliver – informing regulatory policy

Using a Design-led thinking framework to bring together a range of qualitative insights from FCA market specialists along with robust findings from online experiments, demonstrates how a more holistic understanding of consumer behaviour can be used to support policy makers.

What is more, the qualitative aspect of design-led thinking also highlights aspects of consumer behaviour that will provide the basis for future research.

This could include taking a closer look at what other factors within financial promotions may have contributed to consumer misapprehension of the investment risk associated with mini-bonds and other high risk investments (HRIs). Are there certain features that are more likely to carry connotations of safety for typical retail consumers as opposed to market professionals?

And beyond this, broader research into the market for high-risk investments, again using Design-led thinking, will be used to glean further insights into consumers decision-making processes and crucially their comprehension of risk as retail investors search for yield in this historically low interest period.