Eight years ago, G20 leaders met in downtown Pittsburgh and reached important agreements on measures to address the risks revealed by the global financial crisis. These included a commitment to improve risk management in over-the-counter (OTC) derivatives markets.

In 2012 the EU responded by enacting the European Market Infrastructure Regulation (or EMIR). This included a requirement for businesses on either side of derivative deals to make daily payments to cover fluctuations in trading positions. In other words, if your trade loses value – perhaps due to a change in interest rates – you earmark funds to cover for that loss. The same applies when the other party is on the losing side.

This variation margin requirement, as it is known, is not big news outside finance. But it is significant because it reduces the knock-on impact of derivative counterparties going bust.

Given the fact derivatives were a big factor in the build-up of systemic risk during the financial crisis, with large numbers of banks embroiled in risky trades, this is important. Prior to the crisis, few tools were readily available for regulators and central banks to see what the derivatives market looked like. This has been rectified with EMIR requiring parties to report derivatives transactions.

The implementation timescale for EMIR’s margin requirements was not without its critics though. Quite a few businesses (especially smaller ones) were concerned they would be temporarily locked out of the market because of tight timelines. The more detailed technical rules under EMIR were not finalised until late last year. Giving firms just a few months to file all their legal documentation to carry on trading before EMIR’s March 1, 2017 deadline.

Overview of analysis

So what happened? Early derivatives trading data suggests a broadly positive story.

We think some businesses were affected. But in the main, analysis of our data from firms suggests EMIR did not have a significant market impact. Both in terms of overall activity, as well as on the number of different counterparties trading in the market.

Looking at derivatives trades where at least one of the counterparties is a European entity, we first analysed activity levels relating to the initial implementation deadline of February 4, which only affected the largest counterparties trading with each other.

Our expectation was that these firms would be prepared and the data backs that up. Trading activity stayed within normal levels around and after 4 February.

Next, we monitored trading before and after the 1 March implementation date – when the rules took effect for all other counterparties.

Our data shows a spike in trading activity in the period immediately before 1 March. Anecdotal evidence suggests counterparties front-loaded transactions ahead of this date to avoid dealing with any post-implementation uncertainty.

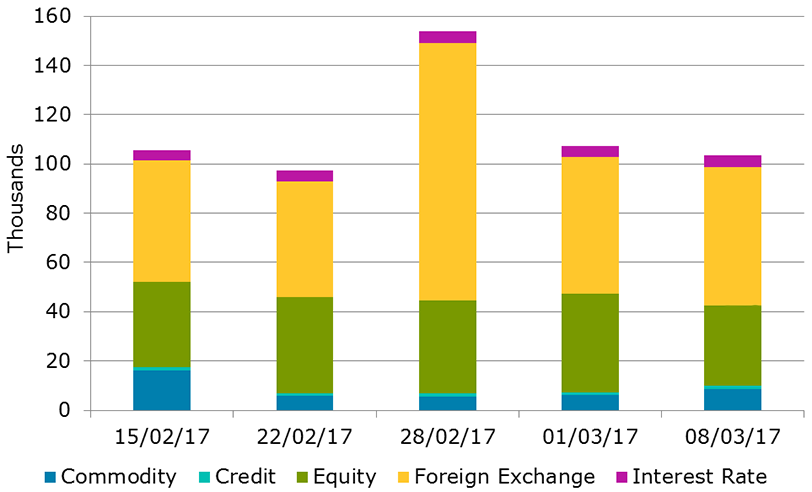

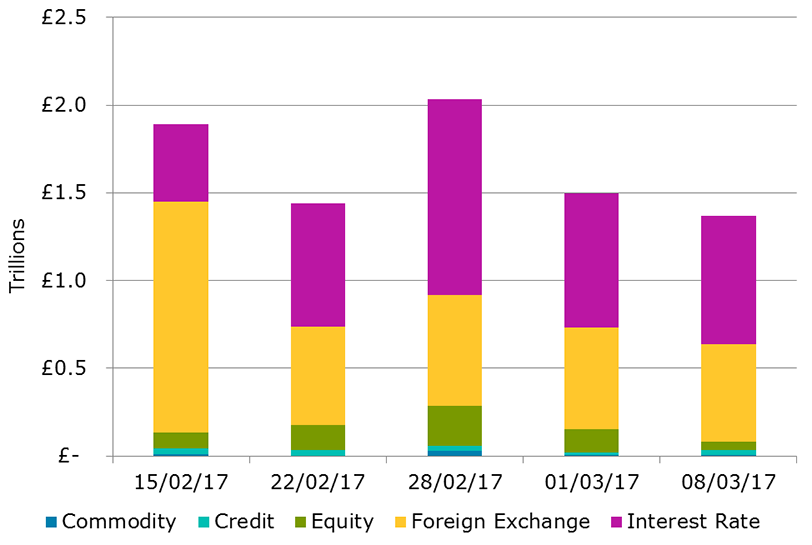

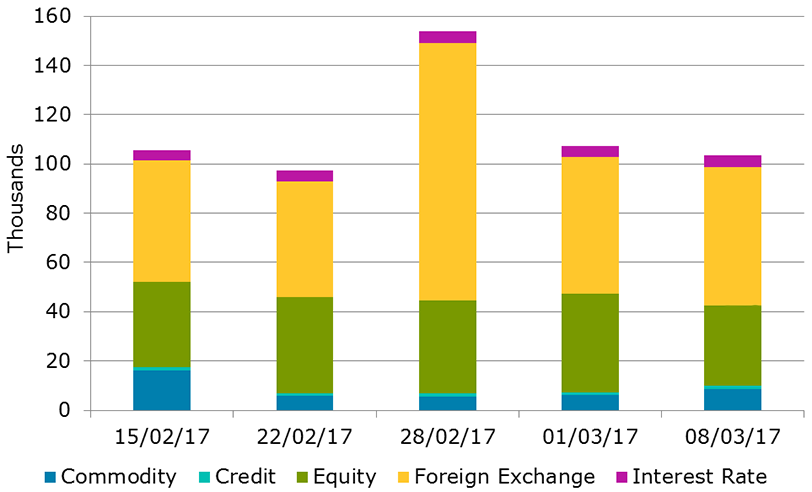

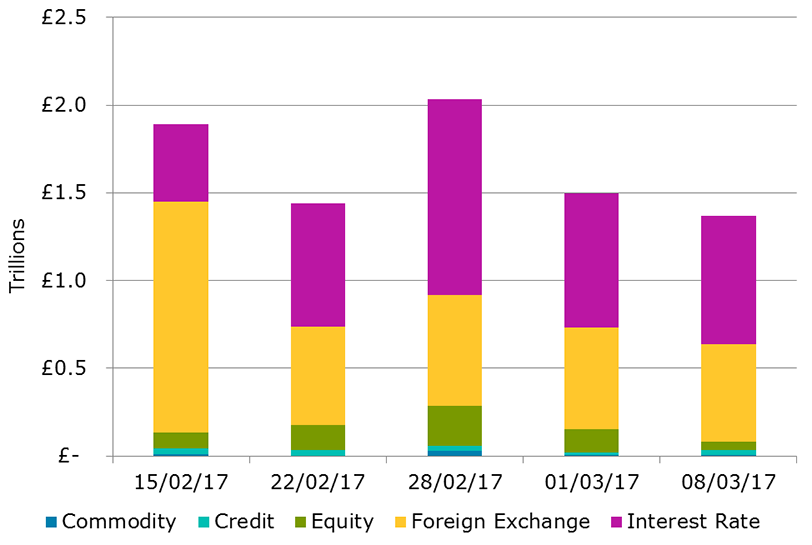

Importantly though, there does not appear to have been a material decrease in activity after the implementation deadline – either in total number of trades (Chart 1) or in notional amounts traded (Chart 2) – at least according to our data sample.

Chart 1: Uncleared OTC activity, number of trades

Source: DTCC

We also wanted to check for any significant drop in activity among smaller firms. The OTC derivatives market typically operates a 'hub and spoke' model, with smaller firms conducting their business with large broker-dealers sitting at the centre of the wheel.

Each of those trades leaves a unique fingerprint identifying the firms involved - and allowing us to gauge how many small firms dropped out of the market after March 1. Less unique fingerprints means less ‘counterparty pairs’, which means less firms – which would indicate that the variation margin requirements did have an impact on small firms.

We looked at the counterparty pairs between smaller and large firms both before and after the variation margin requirements were implemented. Again, the data did not show any meaningful decline in numbers.

Chart 2: Uncleared OTC activity, notional amount

Source: DTCC

This should be good news for the European economy. Derivatives are crucially important to the smooth running of our economy. Allowing airlines, for example, to plan for the future by hedging a price for fuel, as a cost of operating, months in advance. Any deterioration in the market would have had significant implications.

But policy makers will need to continue monitoring the impact of EMIR before we can, as G20 leaders in Pittsburgh put it, "turn the page and adopt a set of policies, regulations and reforms to meet the needs of the 21st century global economy".

Fast explainer: EMIR margin requirements

Variation margin is a daily payment equal to the change in value of the contract since the previous payment. The counterparty whose position has lost value – for example because of a change in interest rates – pays the counterparty whose position has gained value. This ensures that if either party becomes insolvent at a future date, exposure on the contract will be limited to price moves after the most recent variation margin payment.

Initial margin is additional collateral designed to cover moves in the market which may arise after the final variation margin payment has been made, but before the solvent firm has successfully closed out and/or replaced the contract.

Variation margin requirements were introduced first for trades between the largest counterparties, classified as those bearing exposure to uncleared OTC derivatives greater than €3 trillion. These firms were required to commence posting variation margin by 4 February. On 1 March, the rules became applicable to all other counterparties. The initial margin requirements will come into force later, in September 2017.

The authors welcome feedback from businesses on how they are progressing with implementation. The team can be contacted direct at [email protected]